3 Candle Pattern

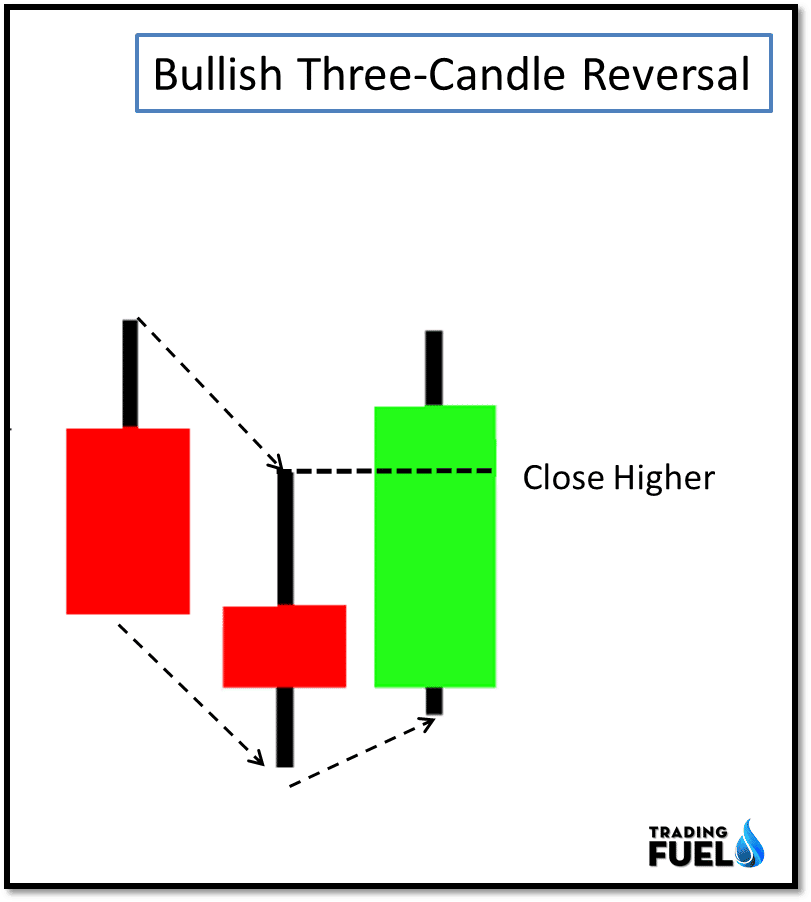

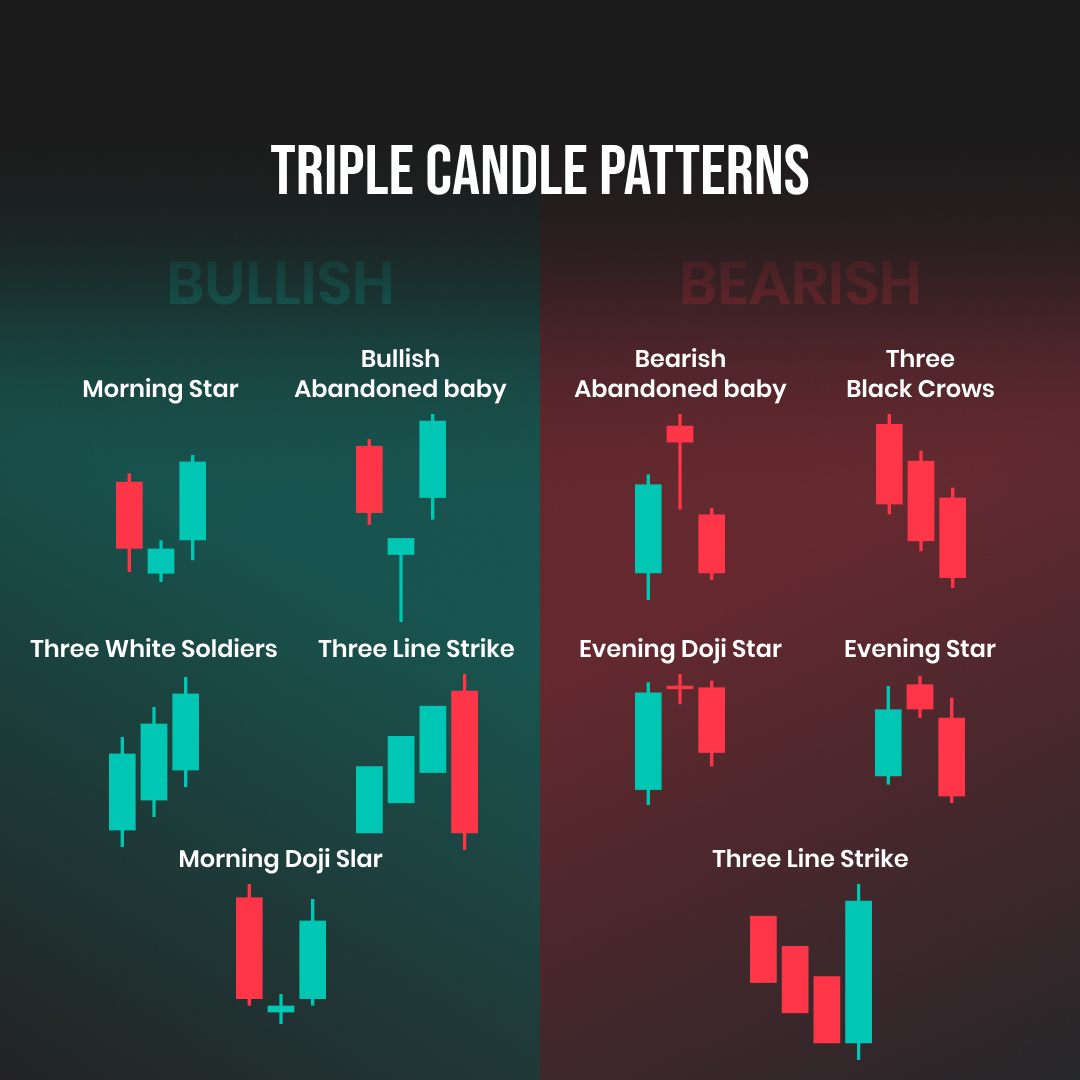

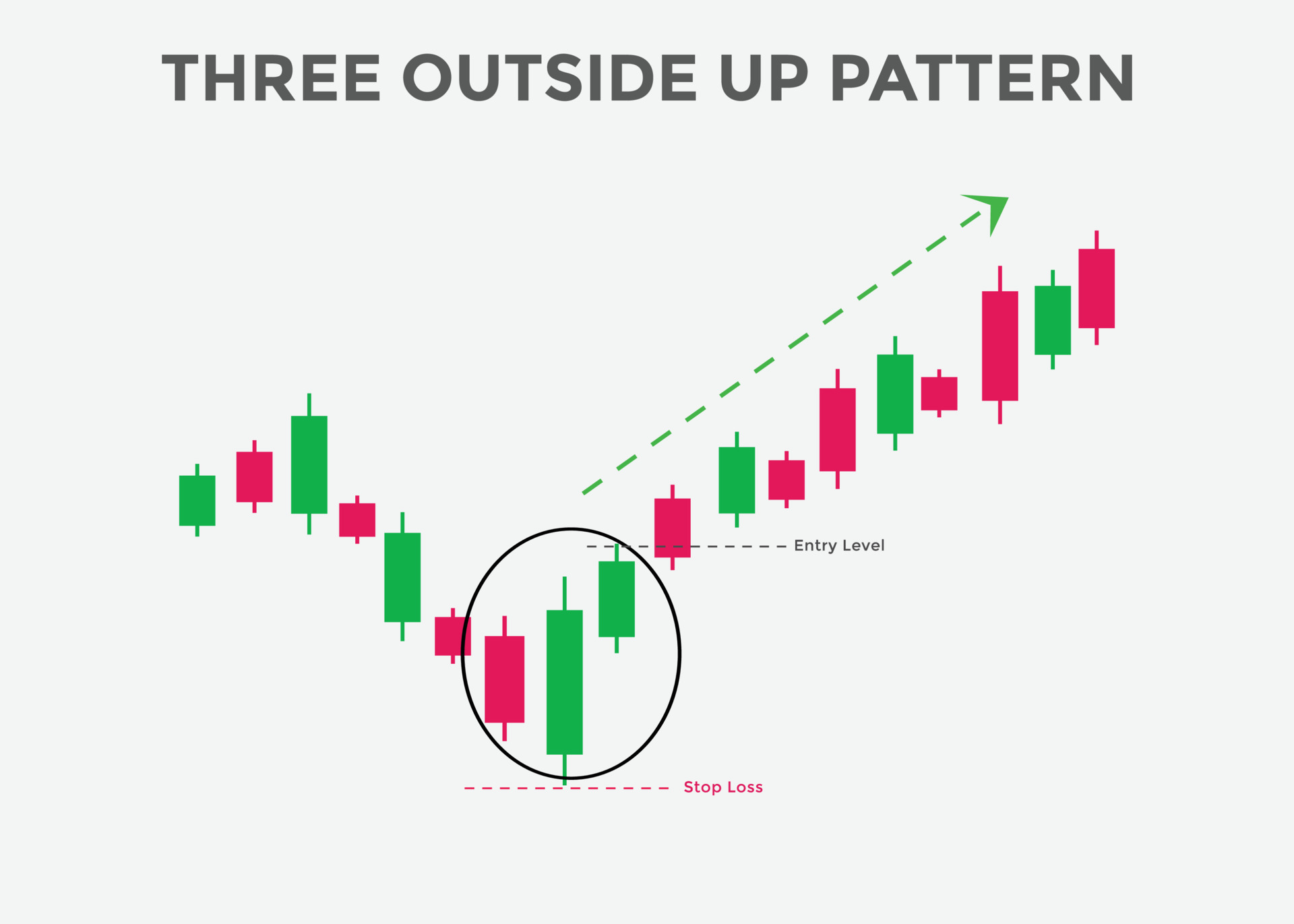

3 Candle Pattern - Triple candlestick patterns are specific formations which are used by investors and traders to predict how the price of a security is going to behave. Web learn about all the trading candlestick patterns that exist: The morning star is a buy indicator. They all offer multiple chart types for price visualization, including candlestick charts. Web the following chart shows an example of a three inside up pattern: I hope you will learn something new from this video. Web one such popular pattern that many traders rely on is the 3 candle pattern. The pattern requires three candles to form in a specific sequence,. Wait until candle 3 closes above 1 and 2 before you go along. Perfect for small businesses, restaurants, hotels, birthday parties and bridal parties. They start with three bearish candlesticks, and then the fourth bullish candlestick engulfs the three bearish ones. The morning star is a buy indicator. The pattern consists of three consecutive candlesticks providing insights into market sentiments and potential price movements. Web some three candlestick patterns are reversal patterns, which signal the end of the current trend and the start of a new trend in the opposite direction. Make candles that stand out. They all offer multiple chart types for price visualization, including candlestick charts. Web plots the 3 candles with an orange indicator using plotshape. Bullish, bearish, reversal, continuation and indecision with examples and explanation. 121k views 3 years ago all candlestick patterns. Web the 3 candlestick rule is a trading strategy that involves examining the last three candles in a chart to predict future price movement. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Web july 12, 2024 / 4:08 pm edt / cbs news. The second candlestick is bullish and should ideally close at the halfway mark of the first candlestick. Web the following chart shows an example of a three inside up pattern: And other. The morning star is a buy indicator. They start with three bearish candlesticks, and then the fourth bullish candlestick engulfs the three bearish ones. Web answer 1 of 15: The pattern consists of three consecutive candlesticks providing insights into market sentiments and potential price movements. Web the 3 candlestick rule is a trading strategy that involves examining the last three. Web a triple candlestick pattern is a price chart formation consisting of three candlesticks that signal either a trend reversal or a trend continuation. Wait until candle 3 closes above 1 and 2 before you go along. It is one of the safest patterns to play in the market. They start with three bearish candlesticks, and then the fourth bullish. Typically, this causes a bullish reversal pattern. We will work with you to create your own signature scent, custom small batch candles, and labels. I hope you will learn something new from this video. Make candles that stand out. Web plots the 3 candles with an orange indicator using plotshape. It is one of the safest patterns to play in the market. This pattern will cut back on trading opportunities and prevent overtrading. And other three candlestick patterns are continuation patterns, which signal a pause and then the continuation of. Web some three candlestick patterns are reversal patterns, which signal the end of the current trend and the start of. And other three candlestick patterns are continuation patterns, which signal a pause and then the continuation of. Web a triple candlestick pattern is a price chart formation consisting of three candlesticks that signal either a trend reversal or a trend continuation. Web the three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period. I hope you will learn something new from this video. And other three candlestick patterns are continuation patterns, which signal a pause and then the continuation of. Bullish, bearish, reversal, continuation and indecision with examples and explanation. This pattern consists of two smaller bars followed by a large third bar, indicating a sharp increase in buying or selling pressure. Web. We will work with you to create your own signature scent, custom small batch candles, and labels. They all offer multiple chart types for price visualization, including candlestick charts. Web the three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. As you can see, i'm a newbie to this. Web a triple candlestick pattern is a price chart formation consisting of three candlesticks that signal either a trend reversal or a trend continuation. Web plots the 3 candles with an orange indicator using plotshape. This script will label all 1 candles (inside candles) with a blue indicator and all 3 candles (engulfing candles) with an orange indicator. Web july. What have charting apps, stock analysis software and technical analysis tools in common? As you can see, i'm a newbie to this forum. The evening star is similar to the. Web july 12, 2024 / 4:08 pm edt / cbs news. Shop online and bring your favorite scent home! Web the following chart shows an example of a three inside up pattern: As you can see, i'm a newbie to this forum. 121k views 3 years ago all candlestick patterns. Web a three line strike pattern consists of four candlesticks that form near support levels. Web we’re relaxing some rules: Typically, this causes a bullish reversal pattern. Web triple candlestick patterns are crucial formations on price charts used to indicate potential trend reversals or continuations, with common examples including morning star, evening star, three white soldiers, and three black crows. Web the 3 bar play pattern is a popular candlestick formation used by traders to identify strong momentum breakouts in either direction. Web learn about all the trading candlestick patterns that exist: The first candlestick is long and bearish, indicating that the market is still in a downtrend. Web the third candlestick is a bullish candlestick that should at least pass the halfway point of the first bearish candle. The second candlestick is bullish and should ideally close at the halfway mark of the first candlestick. Web small batch & wholesale. Web skip to main content. This script will label all 1 candles (inside candles) with a blue indicator and all 3 candles (engulfing candles) with an orange indicator. What have charting apps, stock analysis software and technical analysis tools in common?The Ultimate Candlestick Pattern Cheat Sheet For 2021 Images

An Overview of Triple Candlestick Patterns Forex Training Group

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

Candlestick patterns cheat sheet Artofit

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Candlestick Patterns The Definitive Guide (2021)

Candlestick Pattern Book Candlestick Pattern Tekno

How to trade candlestick patterns? FTMO

Three outside up candlestick pattern. Candlestick chart Pattern For

How To Trade Blog What Is Three Inside Up Candlestick Pattern? Meaning

Web A Triple Candlestick Pattern Is A Price Chart Formation Consisting Of Three Candlesticks That Signal Either A Trend Reversal Or A Trend Continuation.

This Chart Pattern Suggests A Strong Change In.

Make Candles That Stand Out.

They Start With Three Bearish Candlesticks, And Then The Fourth Bullish Candlestick Engulfs The Three Bearish Ones.

Related Post: