Bearish Candle Pattern

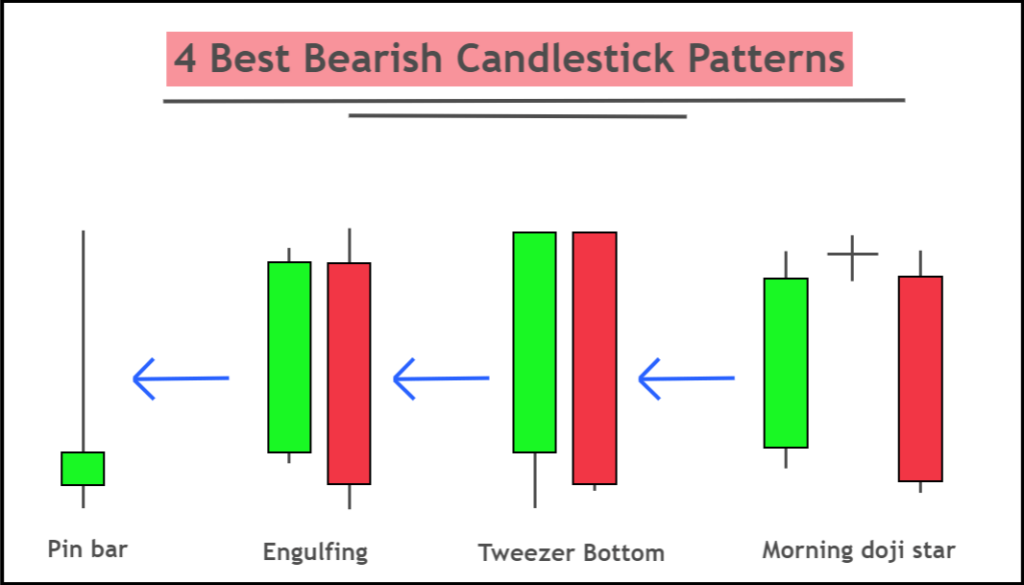

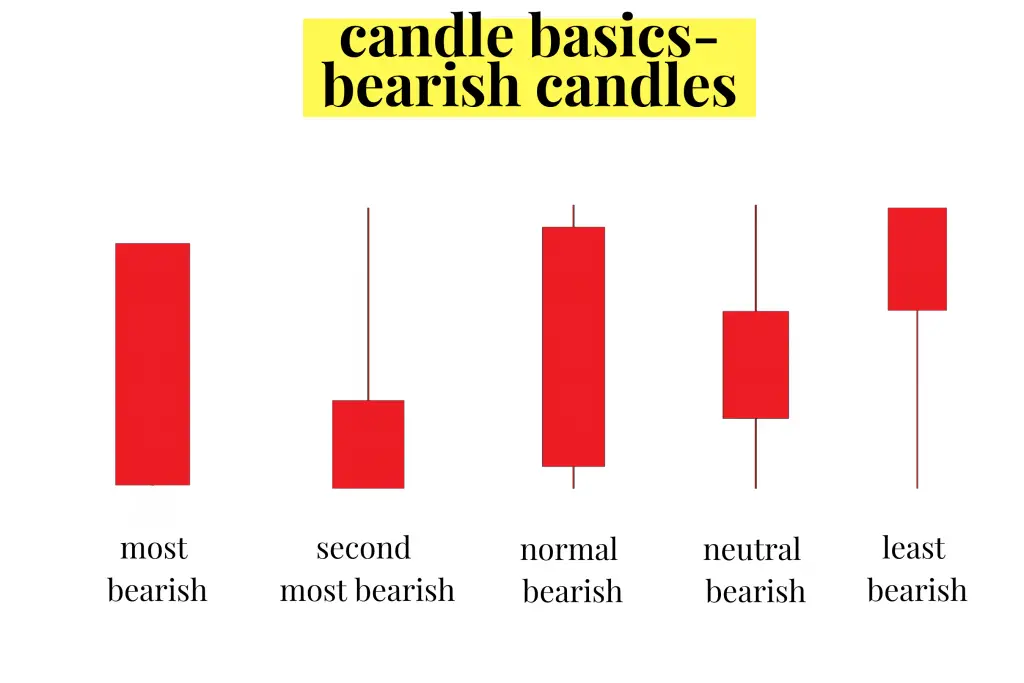

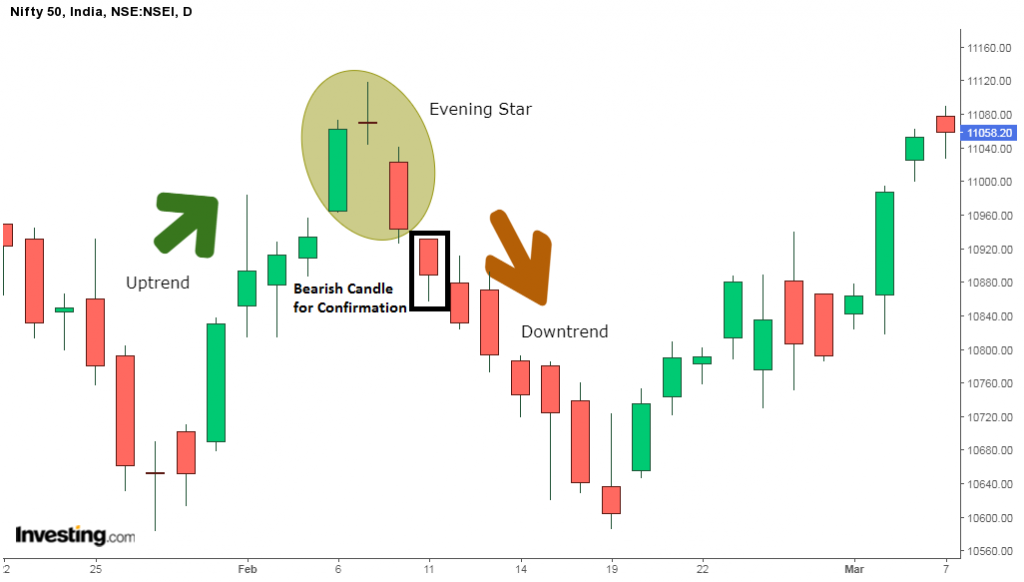

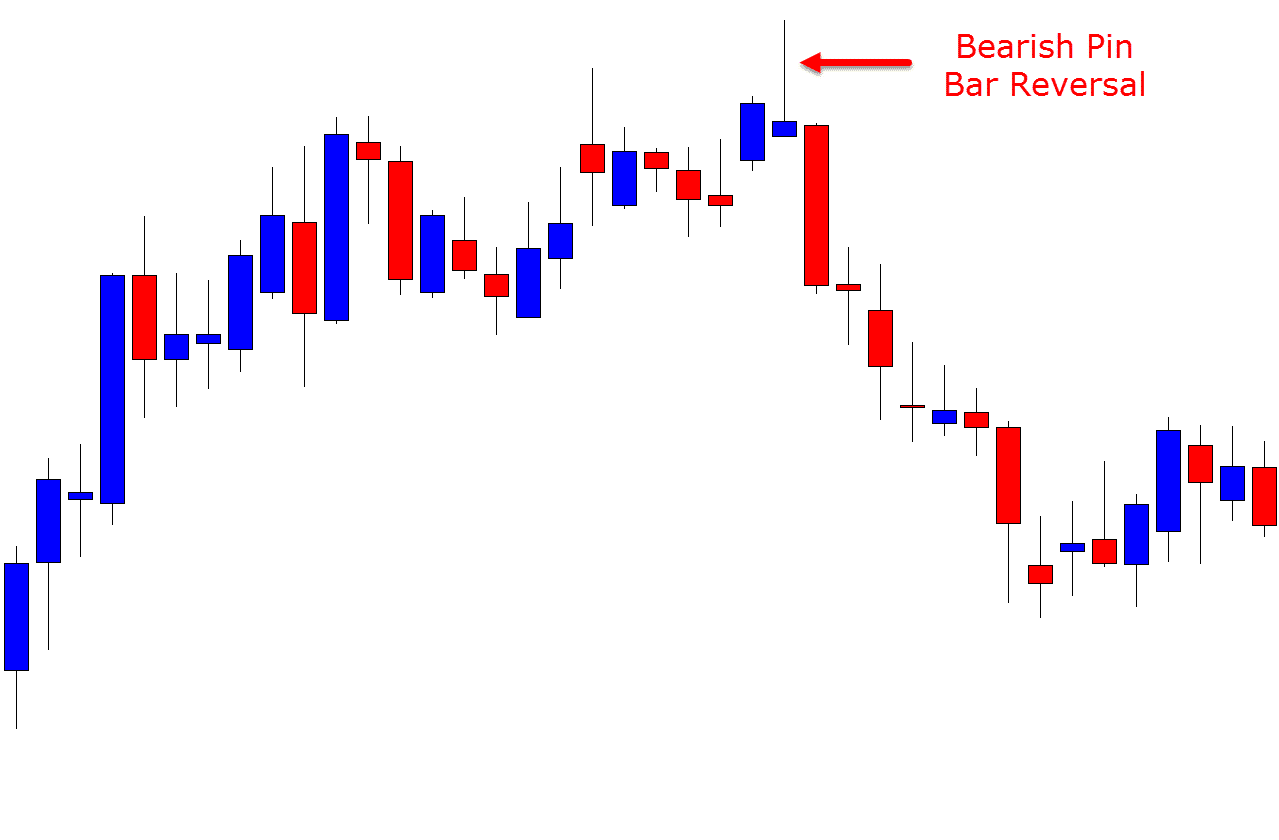

Bearish Candle Pattern - Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Just like sociology, there is no laboratory for finding out the best approach that will guarantee desired results in the stock market. The pattern consists of a long white candle followed by a small black candle. Web the bearish engulfing candlestick pattern is considered to be a bearish reversal pattern, usually occurring at the top of an uptrend. These patterns typically consist of a combination of candles with specific formations, each indicating a shift in market dynamics from buying to selling pressure. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Many of these are reversal patterns. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Bullish candles show that the price of a stock is going up. Comprising two consecutive candles, the pattern features a. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Web candlestick patterns are technical trading formations that help visualize the price movement of a liquid asset (stocks, fx, futures, etc.). For example, candlesticks can be any combination of opposing colors that the trader chooses on some platforms,. Watching a candlestick pattern form can be time consuming and irritating. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. They are typically green or white on stock charts. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. The pattern consists of two candlesticks: How to use bearish candlestick patterns to buy/sell stocks. These patterns often indicate that sellers are in control, and prices may continue to decline. Web bearish candlestick patterns usually form after an uptrend, and signal a. Web what is a bearish candlestick pattern? Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Comprising two consecutive candles, the pattern features a. How to use bearish candlestick patterns to buy/sell stocks. Web what is a bearish candlestick. Which candlestick patterns are bearish? Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Bullish, bearish, reversal, continuation and indecision with examples and explanation. How to trade bearish candlestick pattern. Web in technical analysis, the bearish engulfing pattern is a chart pattern that. Web some common bearish patterns include the bearish engulfing pattern, dark cloud cover, and evening star candlestick, among others. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Mastering key bullish and bearish candlestick patterns gives you an edge. Many of these are reversal patterns. The pattern. Smaller bullish candle (day 1) larger bearish candle (day 2) Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Web the bearish engulfing candlestick pattern is considered to be a bearish reversal pattern, usually occurring at the top of an uptrend. These patterns. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. They are typically red or black on stock charts. A bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Bullish candles show that the price of a stock is going up. Web some. In this article, we are introducing some examples of bearish candlestick patterns. A bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Web 5 powerful bearish candlestick patterns. Traders use it alongside other technical indicators such as the relative strength. These patterns typically consist of a combination of candles with specific. These patterns differ in terms of candlestick arrangements, but they all convey a bearish bias. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Watching a candlestick pattern form can be time consuming. These patterns differ in terms of candlestick arrangements, but they all convey a bearish bias. Web 5 powerful bearish candlestick patterns. Web some common bearish patterns include the bearish engulfing pattern, dark cloud cover, and evening star candlestick, among others. Traders use it alongside other technical indicators such as the relative strength. We have to compare it. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. How to trade bearish candlestick pattern. How to use bearish candlestick patterns to buy/sell stocks. A bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. We have to compare it. In this article, we are introducing some examples of bearish candlestick patterns. Web 5 powerful bearish candlestick patterns. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Many of these are reversal patterns. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Web bearish candles show that the price of a stock is going down. Web some common bearish patterns include the bearish engulfing pattern, dark cloud cover, and evening star candlestick, among others. These patterns typically consist of a combination of candles with specific formations, each indicating a shift in market dynamics from buying to selling pressure.4 Best Bearish Candlestick Patterns ForexBee

Candlestick Patterns Explained New Trader U

Bearish Reversal Candlestick Patterns The Forex Geek

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

Bearish Candlestick Chart

5 Powerful Bearish Candlestick Patterns

bearishreversalcandlestickpatternsforexsignals Candlestick

Candlestick Patterns The Definitive Guide (2021)

What are Bearish Candlestick Patterns

Bearish Candlestick Patterns PDF Guide Free Download

Web What Is A Bearish Candlestick Pattern?

Which Candlestick Patterns Are Bearish?

Traders Use It Alongside Other Technical Indicators Such As The Relative Strength.

They Are Typically Red Or Black On Stock Charts.

Related Post: