Cup And Handle Chart Pattern

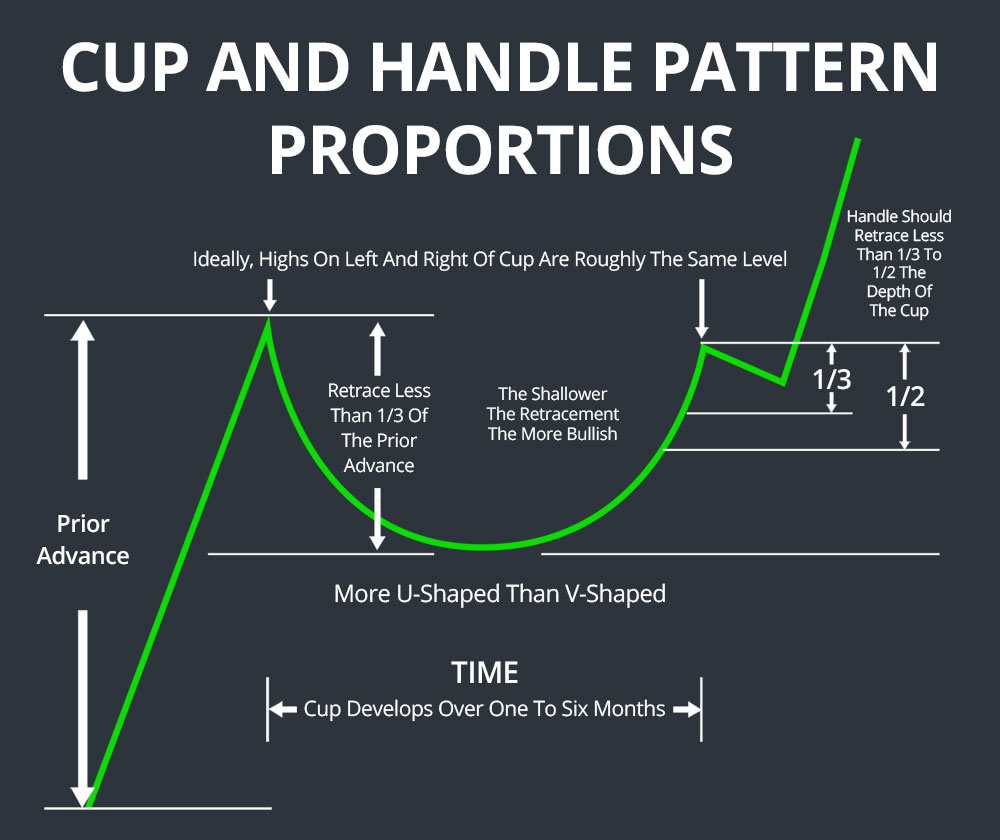

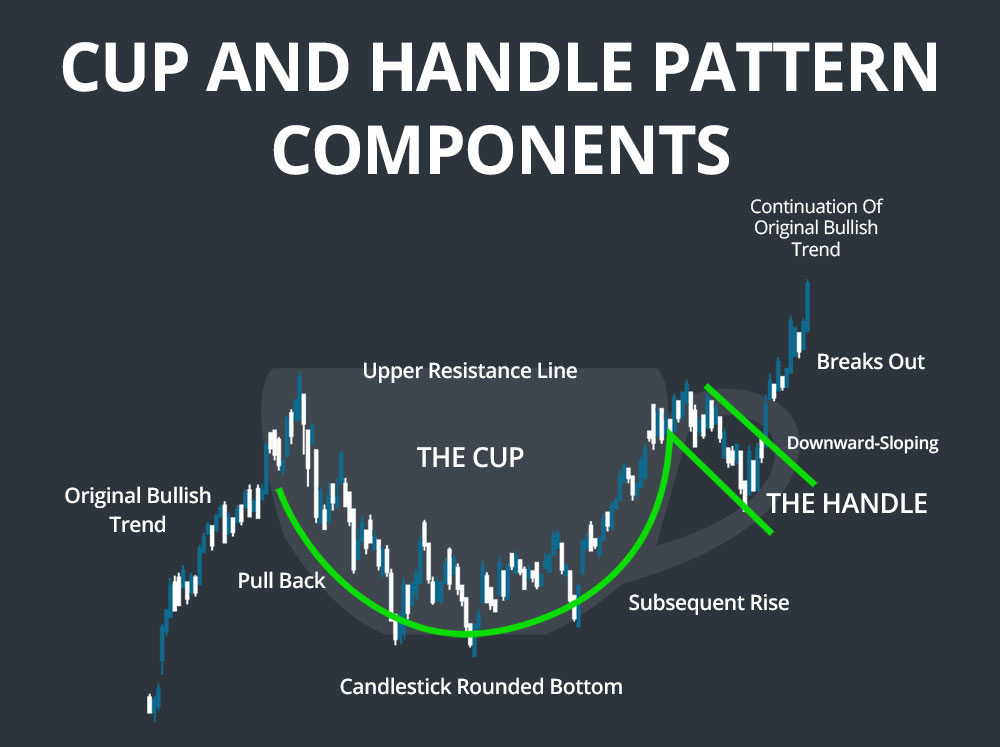

Cup And Handle Chart Pattern - It's the starting point for scoring runs. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. Similar to how cloud patterns can predict an impending storm, the cup and handle pattern provides traders with clues about upcoming shifts in the financial weather. The handle — a tight consolidation is formed under resistance. Reviewed by subject matter experts. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong uptrend. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. The cup is usually “u” shaped and may be considered as a rounding bottom with almost equal highs on the either side. Web the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. There are two parts to the pattern: The cup and the handle. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Web what is a cup and handle chart pattern? Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web what is a cup and handle? Similar to how cloud patterns can predict an impending storm, the cup and handle pattern provides traders with clues about upcoming shifts in the financial weather. Updated on march 29, 2023. Here’s an example from 2019… cup and handle chart example: Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled. Learn how it works with an example, how to identify a target. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Web a ‘cup and handle’ is a chart pattern that can help. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Here’s an example from 2019… cup and handle chart example: Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example,. The pattern starts with a rounded bottom (the cup) that resembles a “u” shape. There are 2 parts to it: The cup is usually “u” shaped and may be considered as a rounding bottom with almost equal highs on the either side. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It's the starting point for scoring runs. The cup is usually “u” shaped and may be considered as a rounding bottom with almost equal highs on the either side. It is considered one of the key signs of bullish continuation,. Let's consider the market mechanics of a typical. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. Learn how to read this pattern, what it means and how to trade. The pattern happens when bulls are overpowered by bears in. Learn how it works with an example, how to. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong uptrend. However, a “v” shaped cup also qualifies as a cup and handle pattern but the conviction is higher in “u” shaped due to the consolidation at the bottom. Web. Learn how to read this pattern, what it means and how to trade. Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. The cup forms after an advance and looks like. However, a “v” shaped cup also qualifies as a cup and handle pattern but the conviction is higher in “u” shaped due to the consolidation at the bottom. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Reviewed by subject matter experts. Written by true tamplin, bsc, cepf®. Here’s. The pattern takes some time to develop, but is relatively straightforward to recognize and trade on once it forms. The cup is usually “u” shaped and may be considered as a rounding bottom with almost equal highs on the either side. Let's consider the market mechanics of a typical. The pattern starts with a rounded bottom (the cup) that resembles. The cup pattern happens first and then a handle happens next. There are 2 parts to it: The pattern starts with a rounded bottom (the cup) that resembles a “u” shape. The handle — a tight consolidation is formed under resistance. The cup and handle is a bullish continuation pattern used to find buying opportunities in the market. Let's consider the market mechanics of a typical. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. See the annotated chart above as you review the 10 steps below: The cup forms after an advance and looks like a bowl or rounding bottom. The cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. Learn how it works with an example, how to identify a target. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. However, a “v” shaped cup also qualifies as a cup and handle pattern but the conviction is higher in “u” shaped due to the consolidation at the bottom. It is important to note that the cup’s shape can vary, with some being shallower or deeper than others. Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend.Cup and Handle Patterns Comprehensive Stock Trading Guide

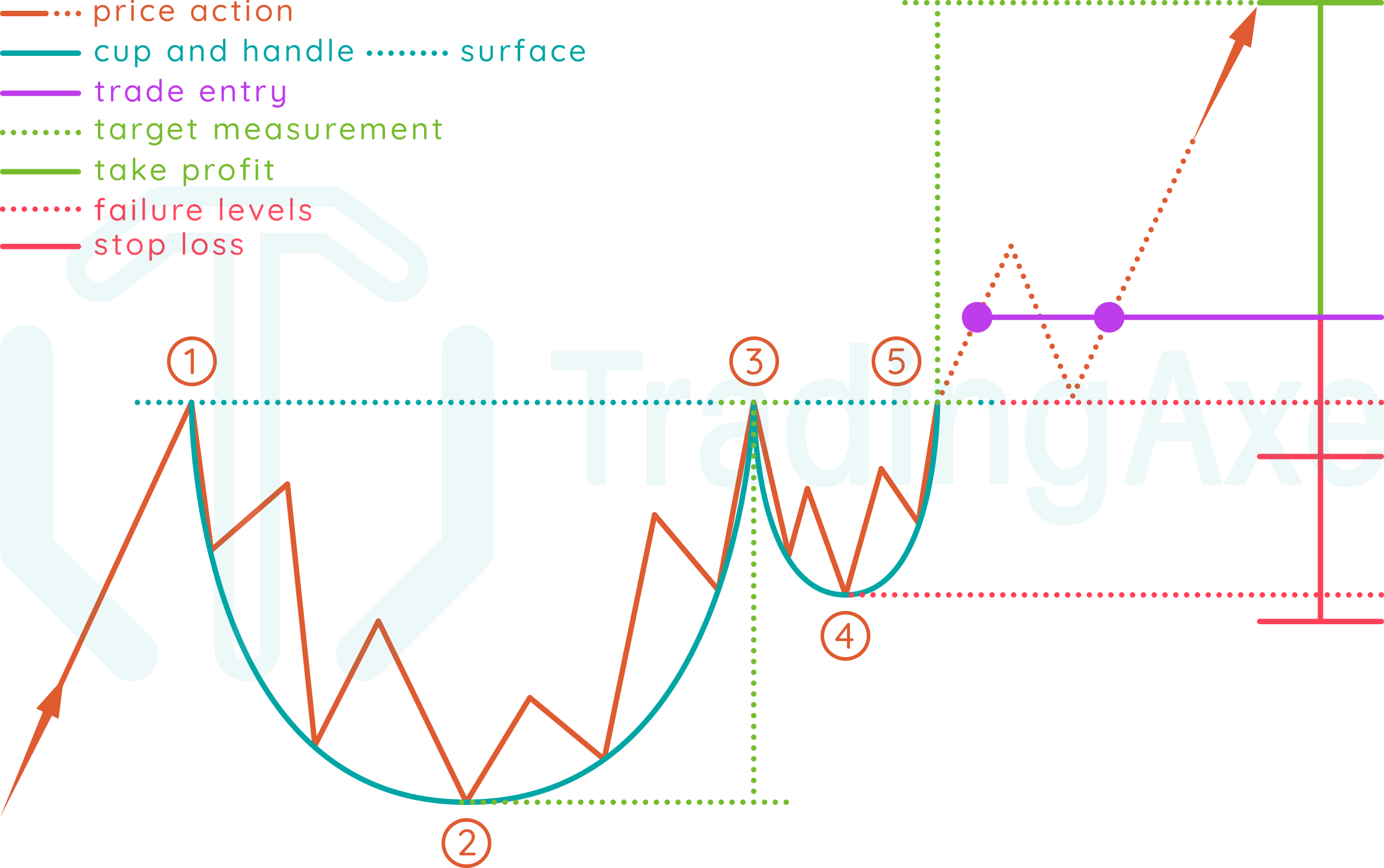

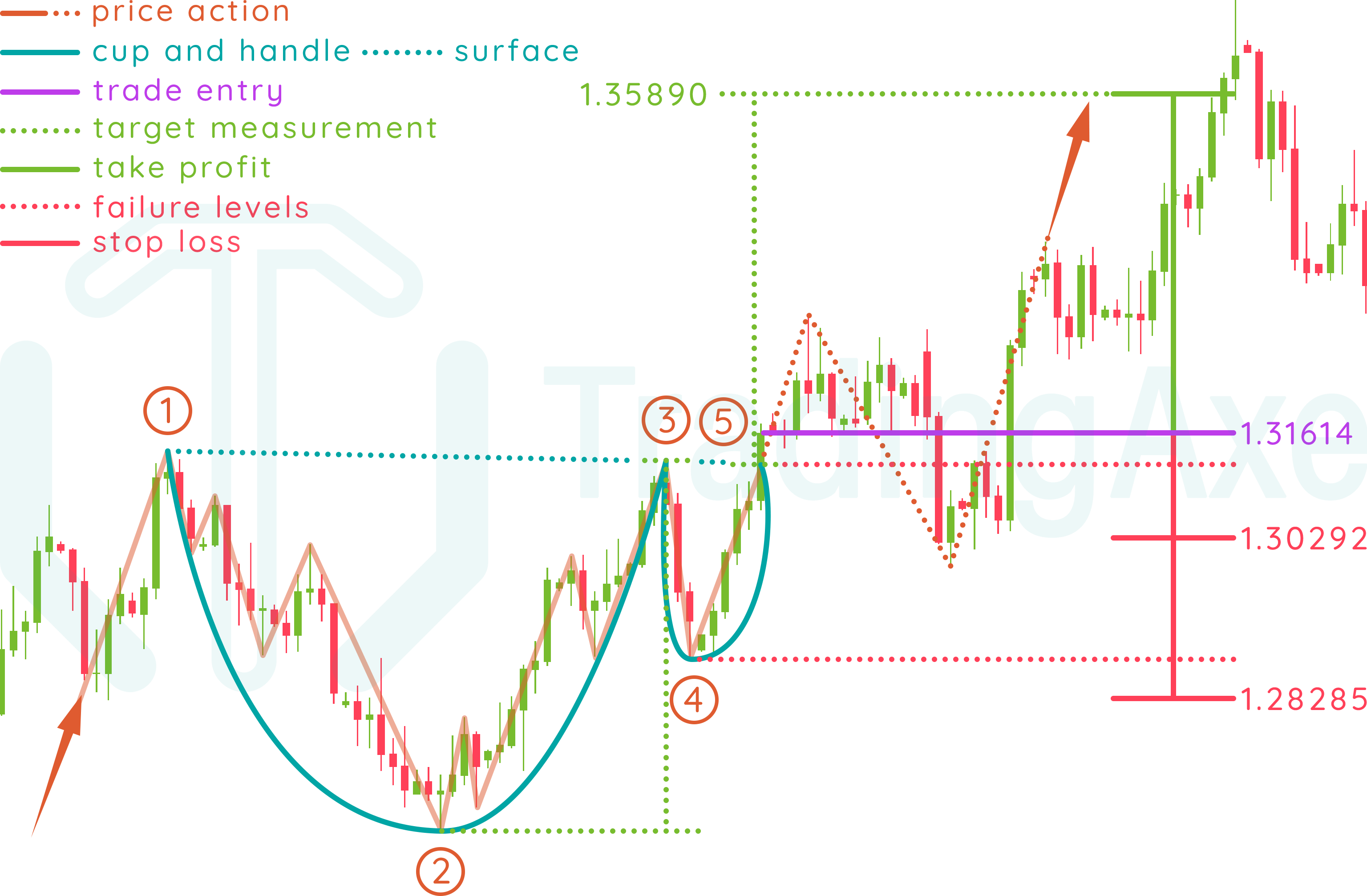

How To Trade Cup And Handle Chart Pattern TradingAxe

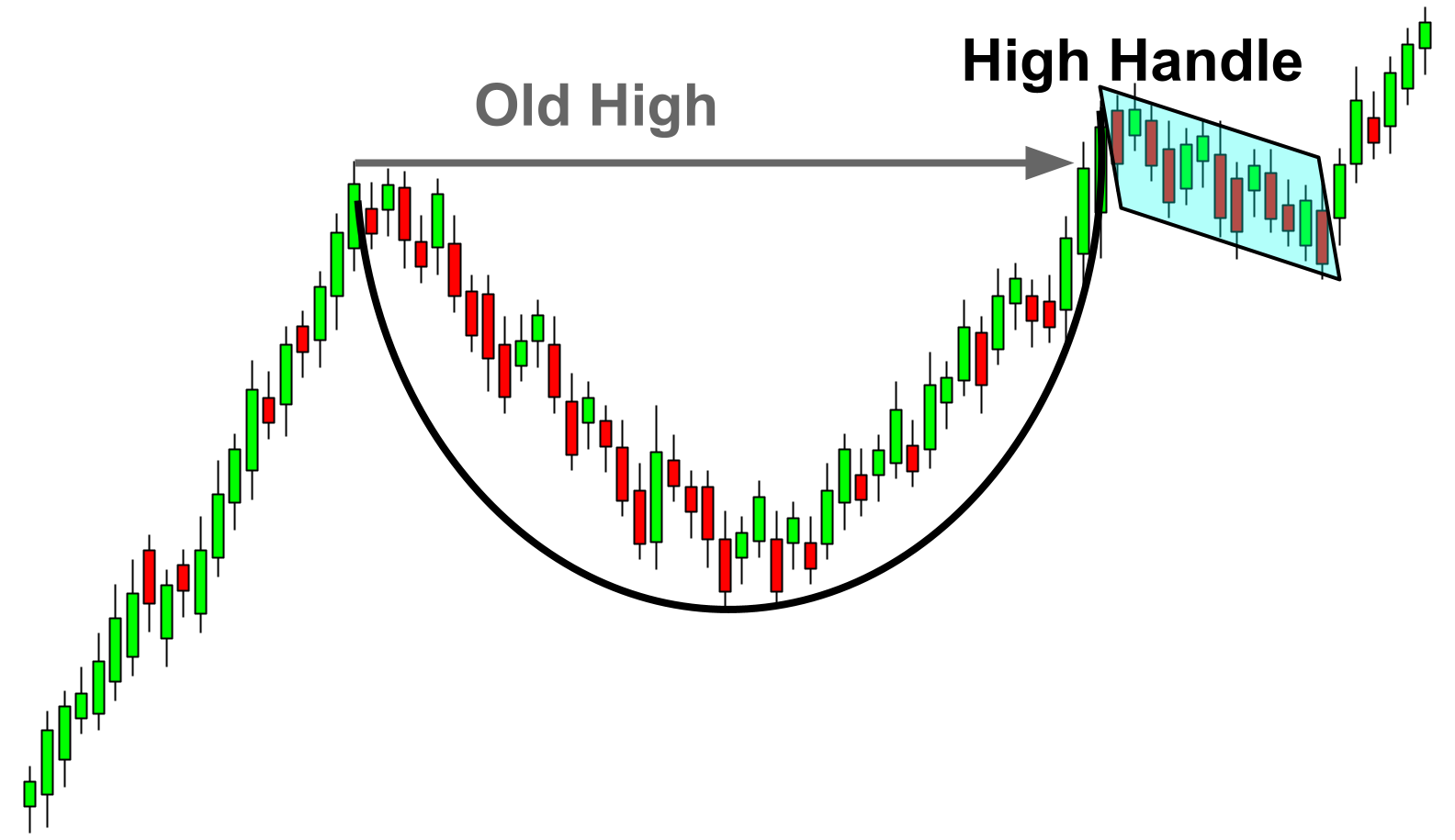

Cup and handle chart pattern How to trade the cup and handle IG UK

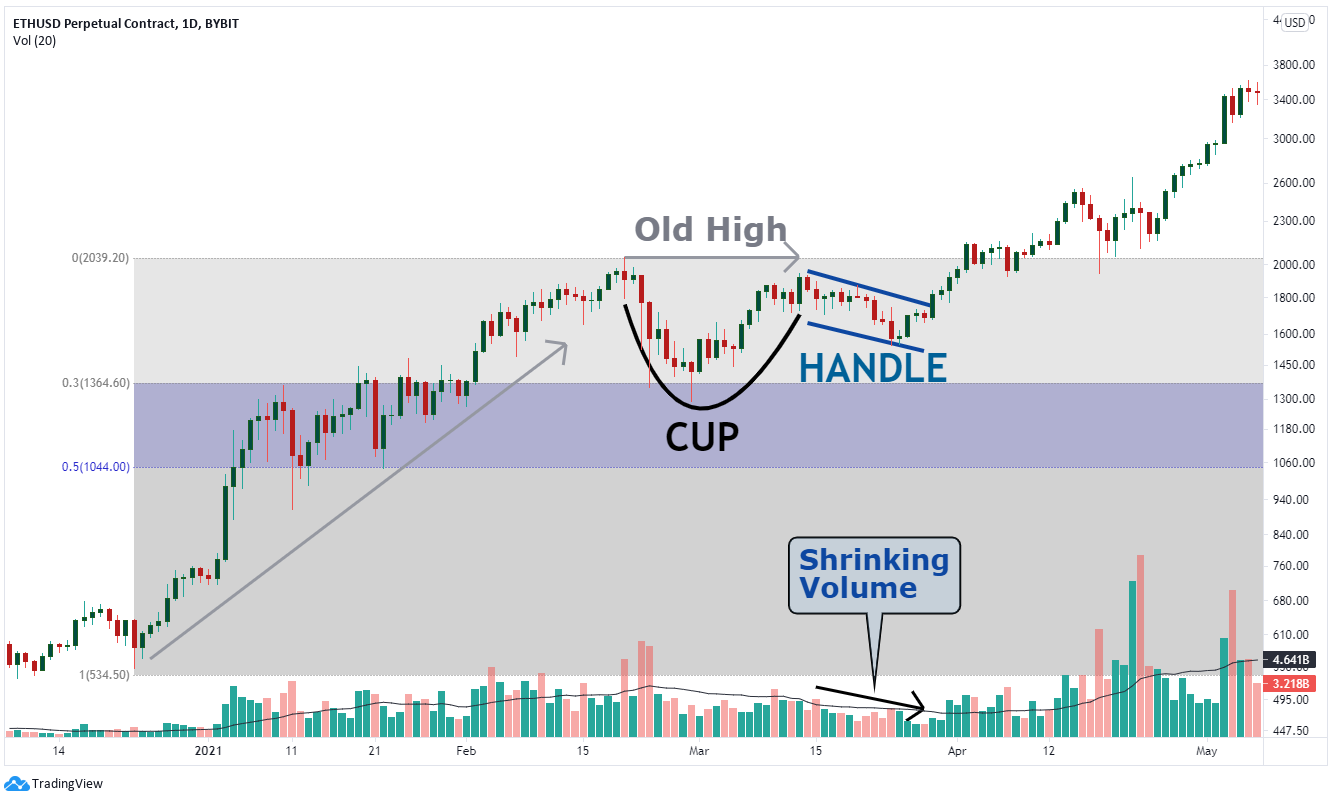

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

How To Trade Cup And Handle Chart Pattern TradingAxe

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

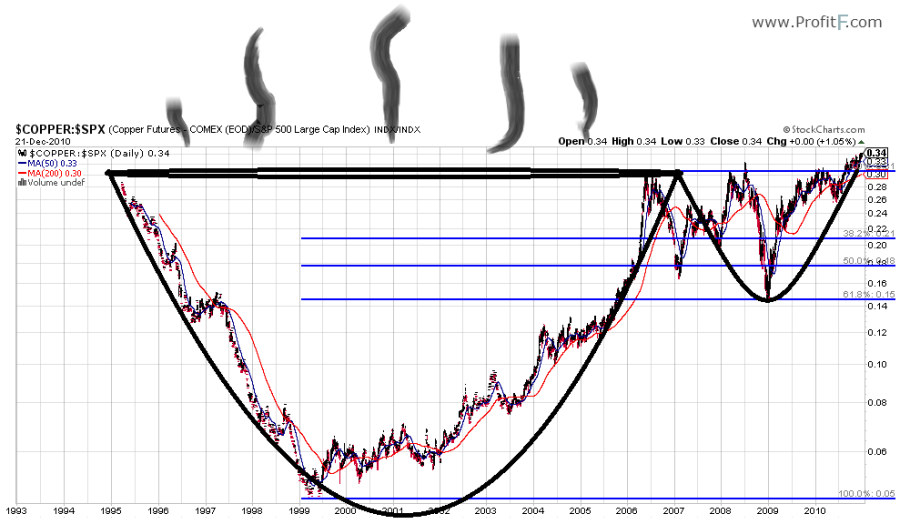

Trading the Cup and Handle Chart pattern

Cup and Handle Pattern Meaning with Example

Web The Cup And Handle Is One Of Many Chart Patterns That Traders Can Use To Guide Their Strategy.

Deconstructing The Cup And Handle.

It's The Starting Point For Scoring Runs.

It Is Considered One Of The Key Signs Of Bullish Continuation, Often Used To Identify Buying Opportunities.

Related Post: