Hammer Candlestick Pattern

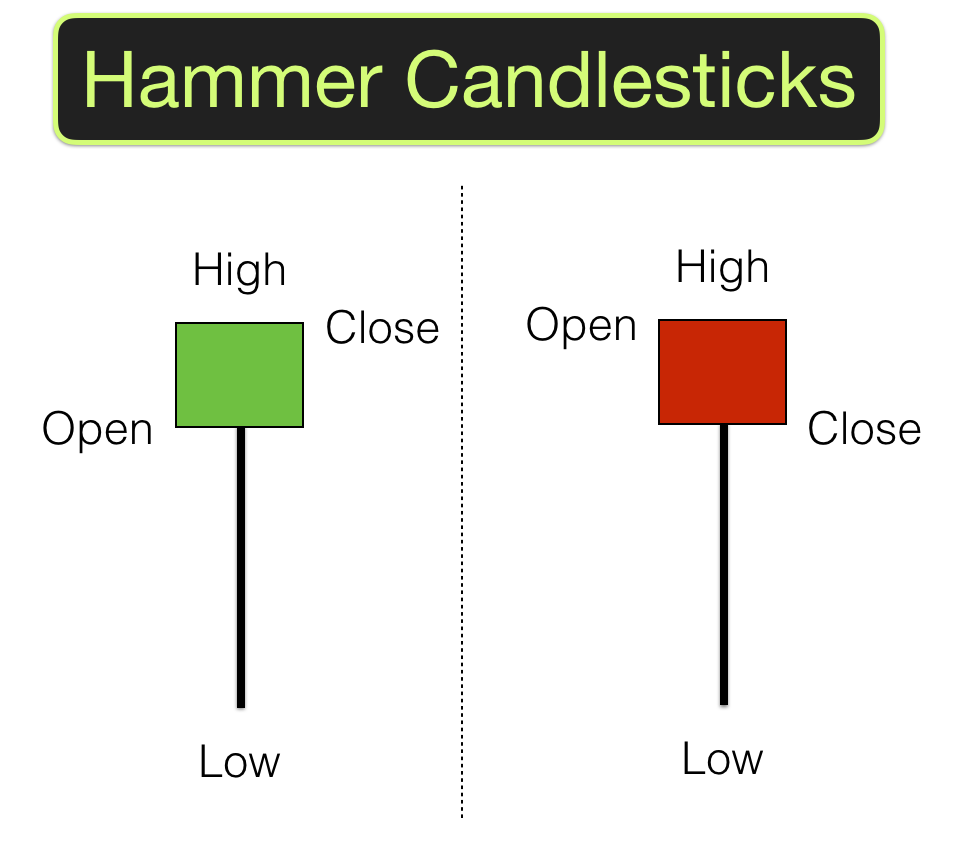

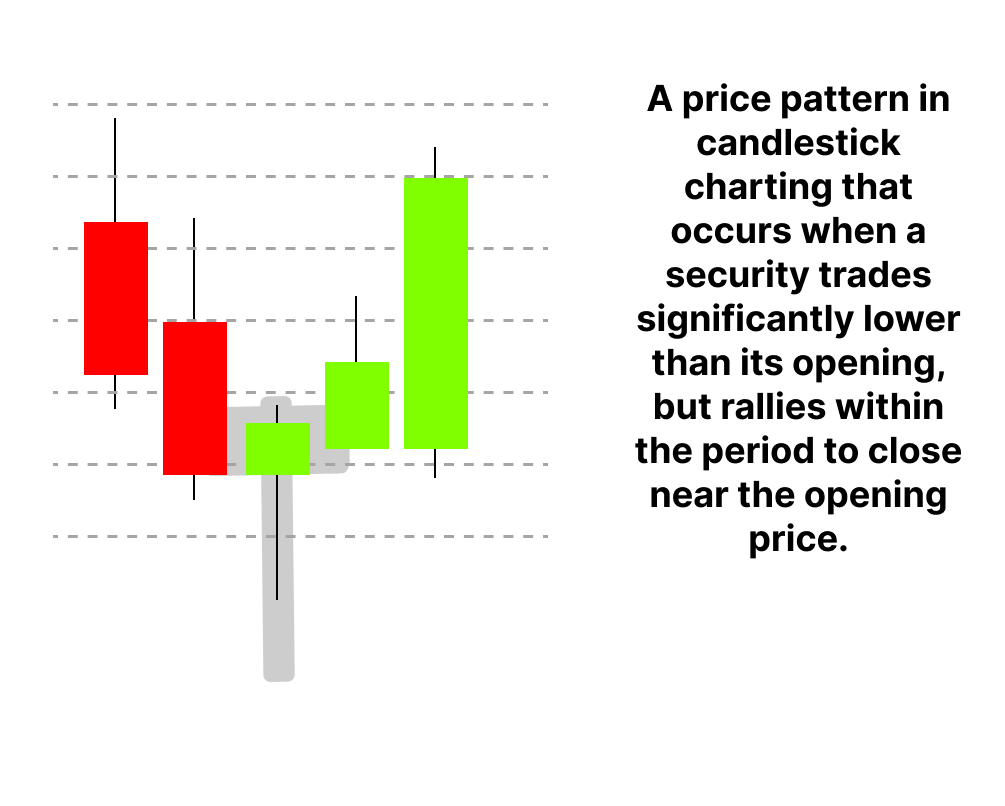

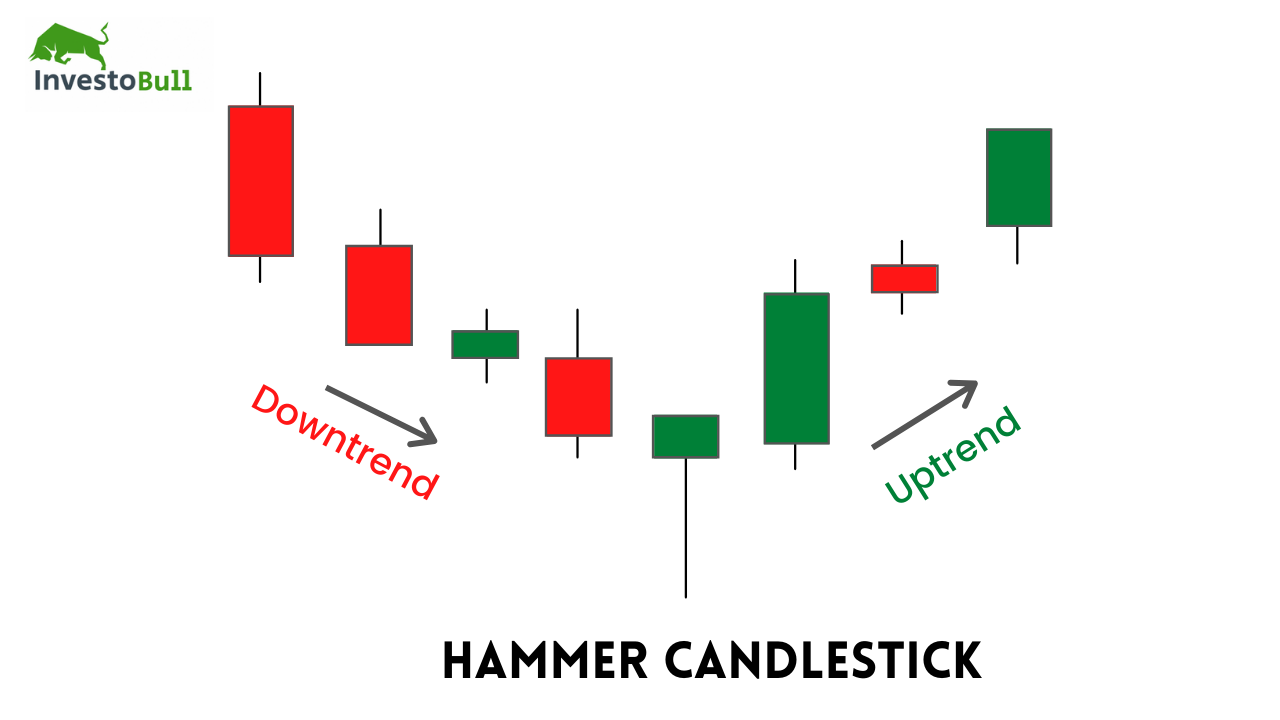

Hammer Candlestick Pattern - A small real body, long. Web the japanese candlestick chart patterns are the most popular way of reading trading charts. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. It resembles a candlestick with a small body and a long lower wick. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. Mysz have been struggling lately and have lost 11.1% over the past week. This article will focus on the famous hammer candlestick pattern. The opening price, close, and top are approximately at the same. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Mysz have been struggling lately and have lost 11.1% over the past week. A small real body, long. It signals that the market is about to change trend direction and advance. The hammer candlestick is a popular chart pattern that suggests bullish sentiment after a day of trading volatility. Web the hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. The opening price, close, and top are approximately at the same. It signals that the market is about to change trend direction and advance. Shares of my size, inc. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. Because they are simple to understand and tend to. The opening price, close, and top are approximately at the same. Web understanding hammer chart and the technique to trade it. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. The hammer candlestick. The hammer signals that price may be about to make a reversal back higher after a recent. Learn what it is, how to identify it, and how to use it for. Mysz have been struggling lately and have lost 11.1% over the past week. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for. This is one of the popular price patterns in candlestick charting. The hammer candlestick pattern is a candle with a short body at the upper end and a long lower shadow, typically twice the body’s length,. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web a hammer is a bullish reversal candlestick pattern. A minor difference between the. This pattern typically appears when a. The hammer candlestick pattern is a candle with a short body at the upper end and a long lower shadow, typically twice the body’s length,. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web understanding hammer chart and the. It manifests as a single. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. A small real body, long. Web a hammer candlestick is a term used in technical analysis. The hammer signals that price may be about to make a reversal back higher after a recent. Web hammer candlestick pattern consists of a single candlestick & its name is derived from its shape like a hammer having long wick at bottom and a little body at top. This article will focus on the famous hammer candlestick pattern. Web the hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in. They consist of small to medium size lower shadows, a real. Web what is a hammer candlestick pattern? This is one of the popular price patterns in candlestick charting. In japanese, it is called takuri meaning feeling the bottom with. Web hammer candlestick pattern consists of a single candlestick & its name is derived from its shape like a hammer. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. In japanese, it is called takuri meaning feeling the bottom with. It appears during the downtrend and signals that the. This pattern typically appears when a. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Web hammer candlestick pattern consists of a single candlestick & its name is derived from its shape like a hammer having long wick at bottom and a little body at top. Web hammer candlesticks are. This article will focus on the famous hammer candlestick pattern. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. This is one of the popular price patterns in candlestick charting. Learn what it is, how to identify it, and how to use it for. It resembles a candlestick with a small body and a long lower wick. The hammer candlestick pattern is a candle with a short body at the upper end and a long lower shadow, typically twice the body’s length,. Mysz have been struggling lately and have lost 11.1% over the past week. Typically, it will have the. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. Our guide includes expert trading tips and examples. Web a hammer candlestick is a term used in technical analysis. It manifests as a single. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. It signals that the market is about to change trend direction and advance. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets.Hammer Candlestick Pattern Strategy Guide for Day Traders DTTW™

Hammer Candlestick Pattern Trading Guide

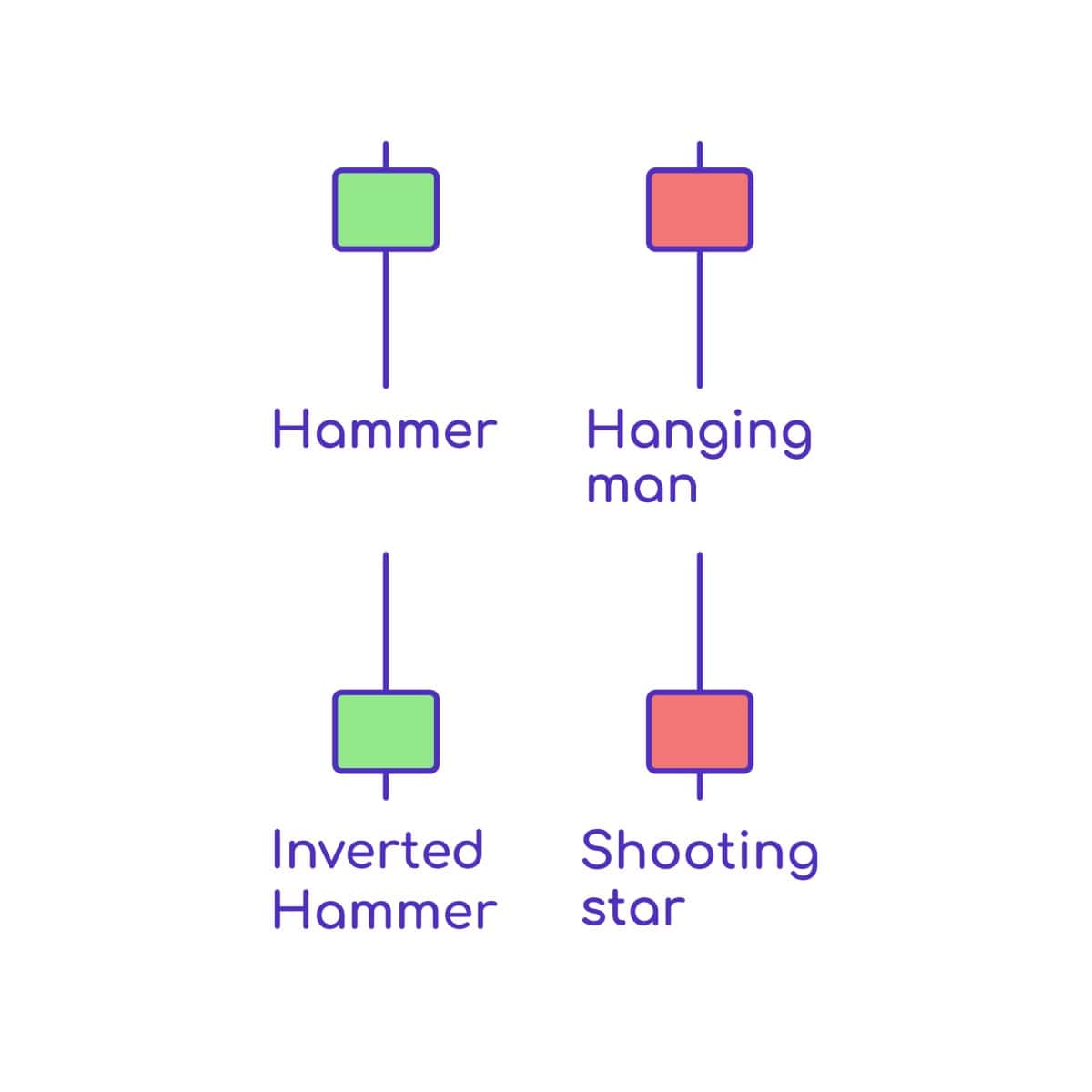

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

What is Hammer Candlestick Pattern June 2024

Hammer Candlestick Pattern Trading Guide

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Patterns (Types, Strategies & Examples)

Hammer Candlestick Pattern The Complete Guide 2023

The Hammer Candlestick Pattern Identifying Price Reversals

Shares Of My Size, Inc.

The Hammer Signals That Price May Be About To Make A Reversal Back Higher After A Recent.

Web Understanding Hammer Chart And The Technique To Trade It.

A Minor Difference Between The.

Related Post: