Inverse Head And Shoulder Pattern

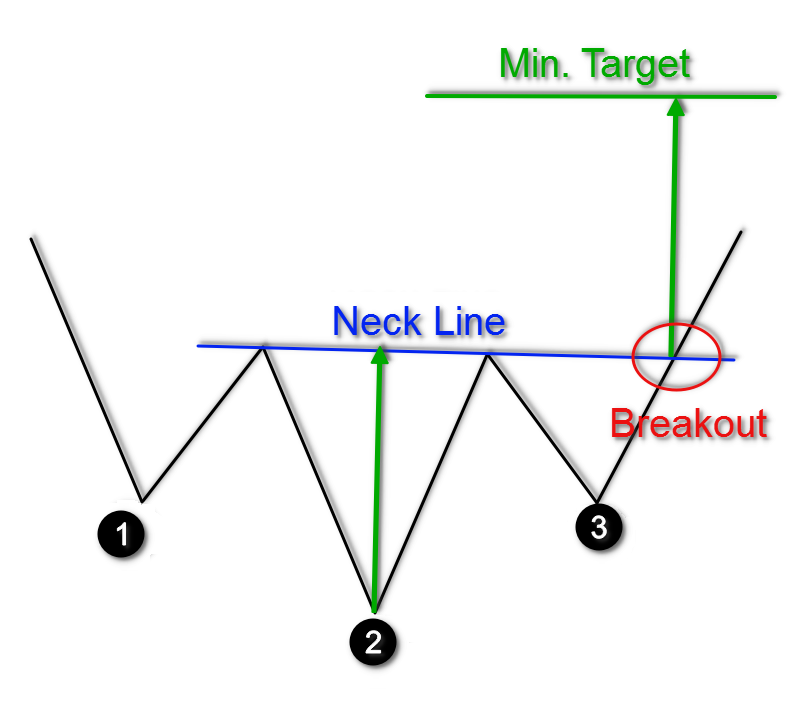

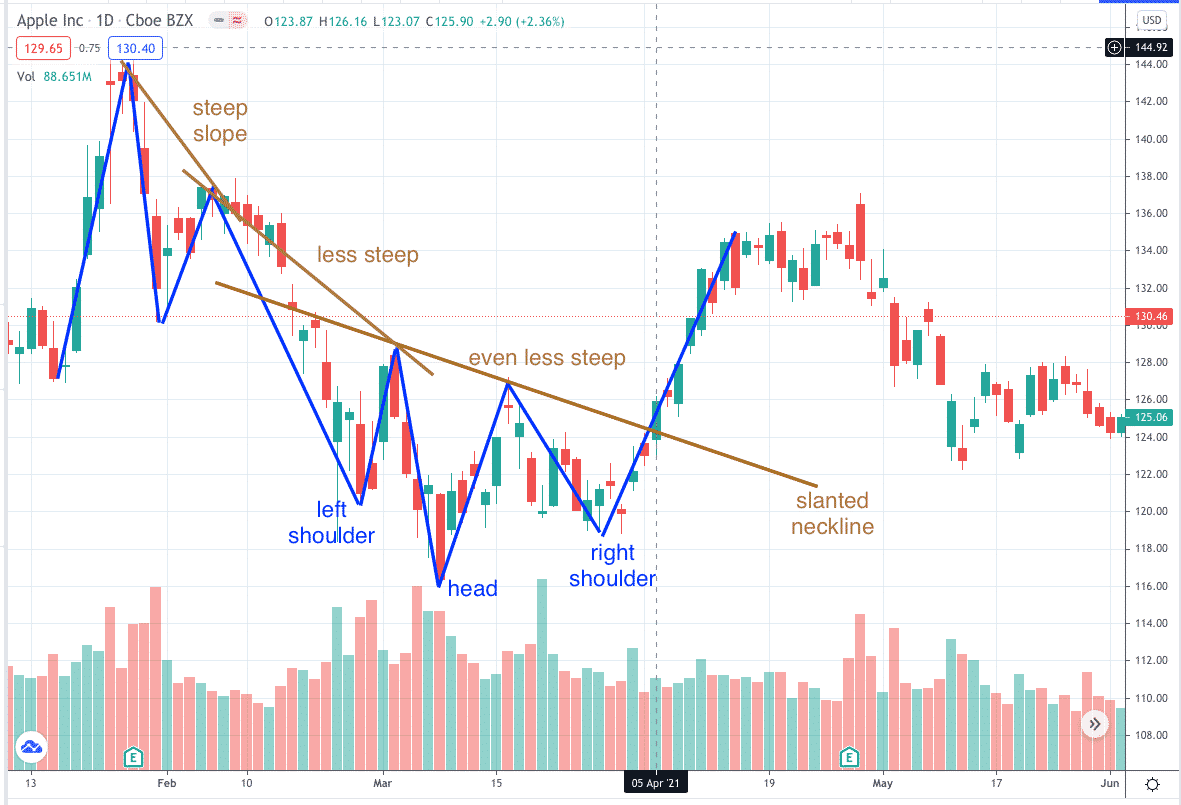

Inverse Head And Shoulder Pattern - Web it is simply called the inverse head and shoulders pattern and is an accumulation pattern. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. Read about head and shoulder pattern here: It is the opposite of the head and. This pattern is formed when an asset’s price. Inverse h&s pattern is bullish reversal. It’s a chart pattern i’ve used for over a decade and is incredibly. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Web the inverse head and shoulders pattern is a fantastic bullish reversal pattern that new traders should add to their list of patterns to learn to trade. Traders measure the distance between the bottom of the. In this tutorial, we'll go into detail on what the inverse head and. The left shoulder forms when investors pushing a stock higher. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. Inverse h&s pattern is bullish reversal. Web the inverse head and shoulders pattern is a fantastic bullish reversal pattern that new traders should add to their list of patterns to learn to trade. Web most notably, it has also formed an inverse head and shoulders chart pattern, which is often a bullish sign. Web it is simply called the inverse head and shoulders pattern and is an accumulation pattern. Traders measure the distance between the bottom of the. It is of two types:. It’s a chart pattern i’ve used for over a decade and is incredibly. Traders measure the distance between the bottom of the. The weekly chart provides more hints about what to expect. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. However, not much is written. Web an inverse head and shoulders is an upside down head and shoulders pattern and. It’s a chart pattern i’ve used for over a decade and is incredibly. Web it is simply called the inverse head and shoulders pattern and is an accumulation pattern. It is the opposite of the head and. Inverse h&s pattern is bullish reversal. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end. It represents a bullish signal suggesting. The weekly chart provides more hints about what to expect. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis.. In this tutorial, we'll go into detail on what the inverse head and. Web it is simply called the inverse head and shoulders pattern and is an accumulation pattern. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Web inverse head and shoulders is a price pattern in. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. It is the opposite of the head and. Web the inverse head and shoulders chart pattern is a bullish chart formation. However, not much is written. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end. The weekly chart provides more hints about what to expect. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. Following this, the price generally goes to. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. Read about head and shoulder. It represents a bullish signal suggesting. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. Web the inverse head and shoulders pattern is. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Following this, the. The pattern is similar to the shape. Traders measure the distance between the bottom of the. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Inverse h&s pattern is bullish reversal. Web the inverse head and shoulders pattern is a fantastic bullish reversal pattern that new. In this tutorial, we'll go into detail on what the inverse head and. The weekly chart provides more hints about what to expect. The pattern is similar to the shape. Read about head and shoulder pattern here: Inverse h&s pattern is bullish reversal. Following this, the price generally goes to. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. You can enter a long position when the price moves above the neck,. Traders measure the distance between the bottom of the. Web it is simply called the inverse head and shoulders pattern and is an accumulation pattern. The left shoulder forms when investors pushing a stock higher. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. It is of two types:. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend.How To Trade Blog What is Inverse Head and Shoulders Pattern

Inverse Head and Shoulders What the Pattern Means in Trading

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

Inverse Head and Shoulders Pattern How To Spot It

Head and Shoulders Trading Patterns ThinkMarkets EN

Chart Patterns The Head And Shoulders Pattern Forex Academy

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Inverse Head and Shoulders Pattern How To Spot It

Inverse Head and Shoulders Pattern Trading Strategy Guide

It Occurs When The Price Hits New.

It Is The Opposite Of The Head And.

It Represents A Bullish Signal Suggesting.

The First And Third Lows Are Called Shoulders.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)