Inverted Hammer Candlestick Pattern

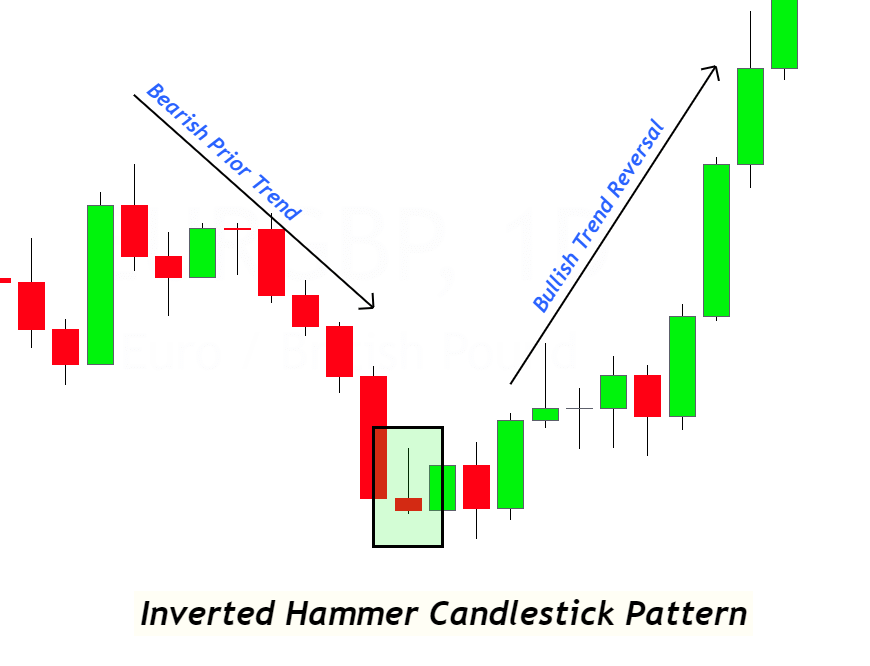

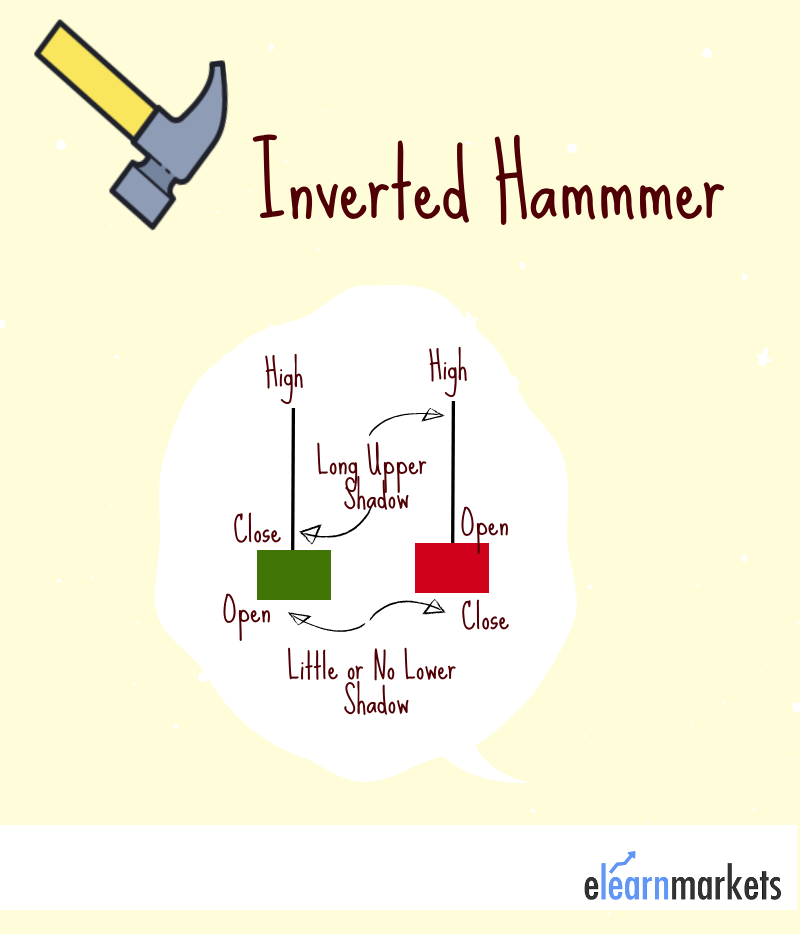

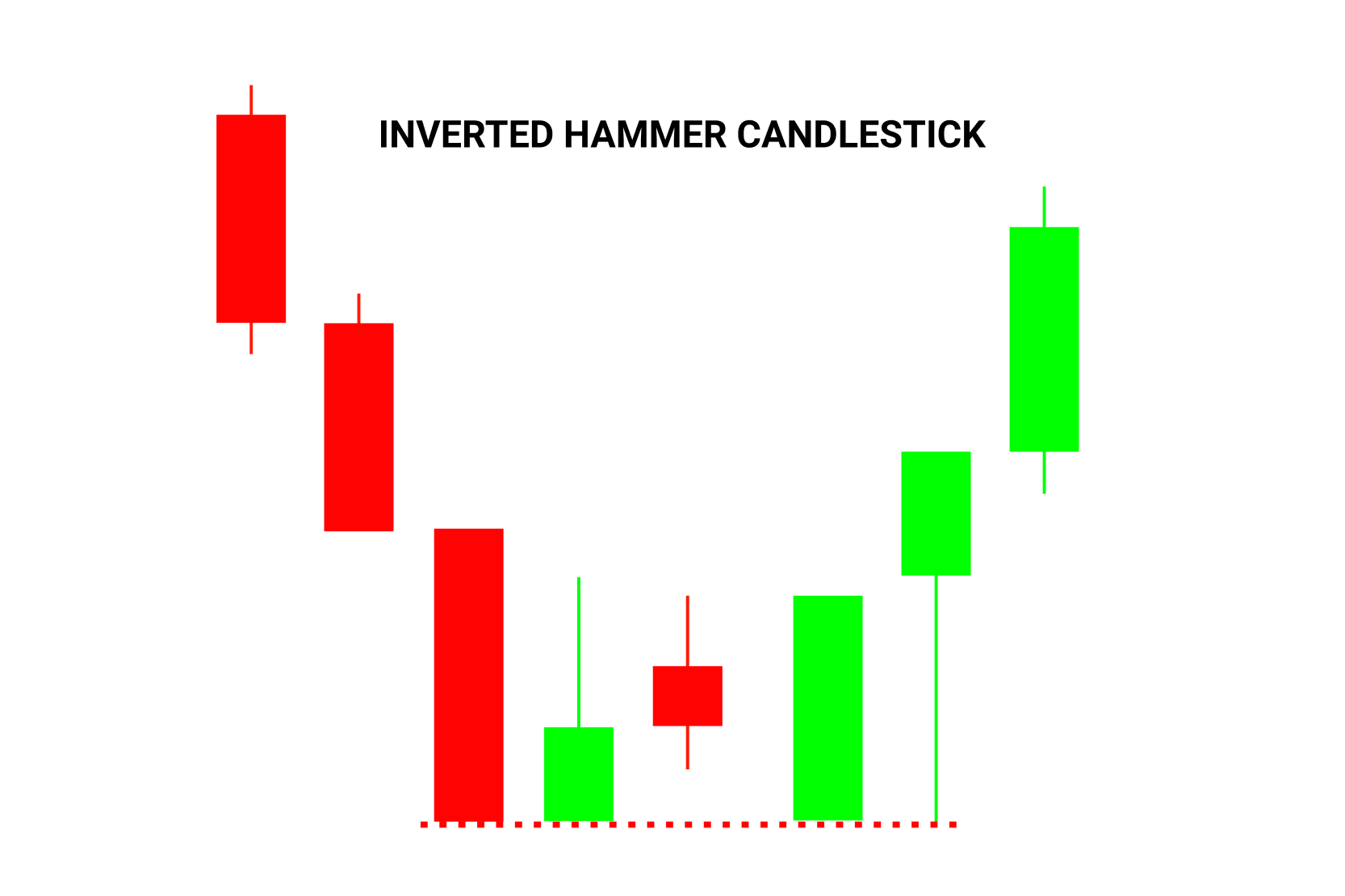

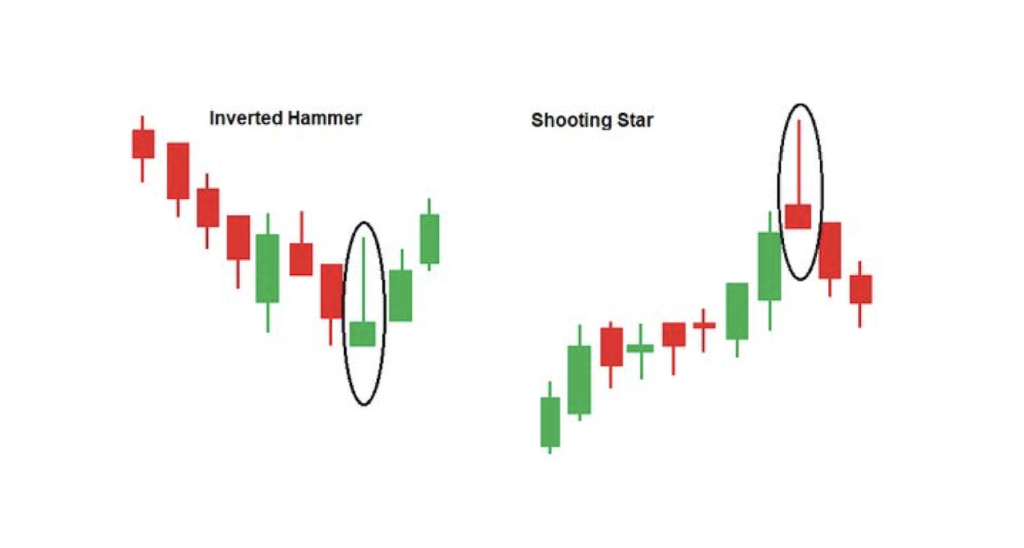

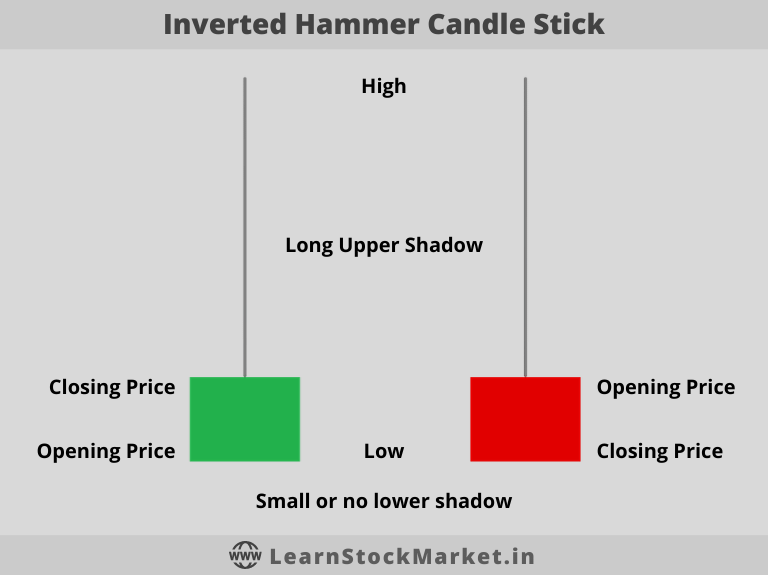

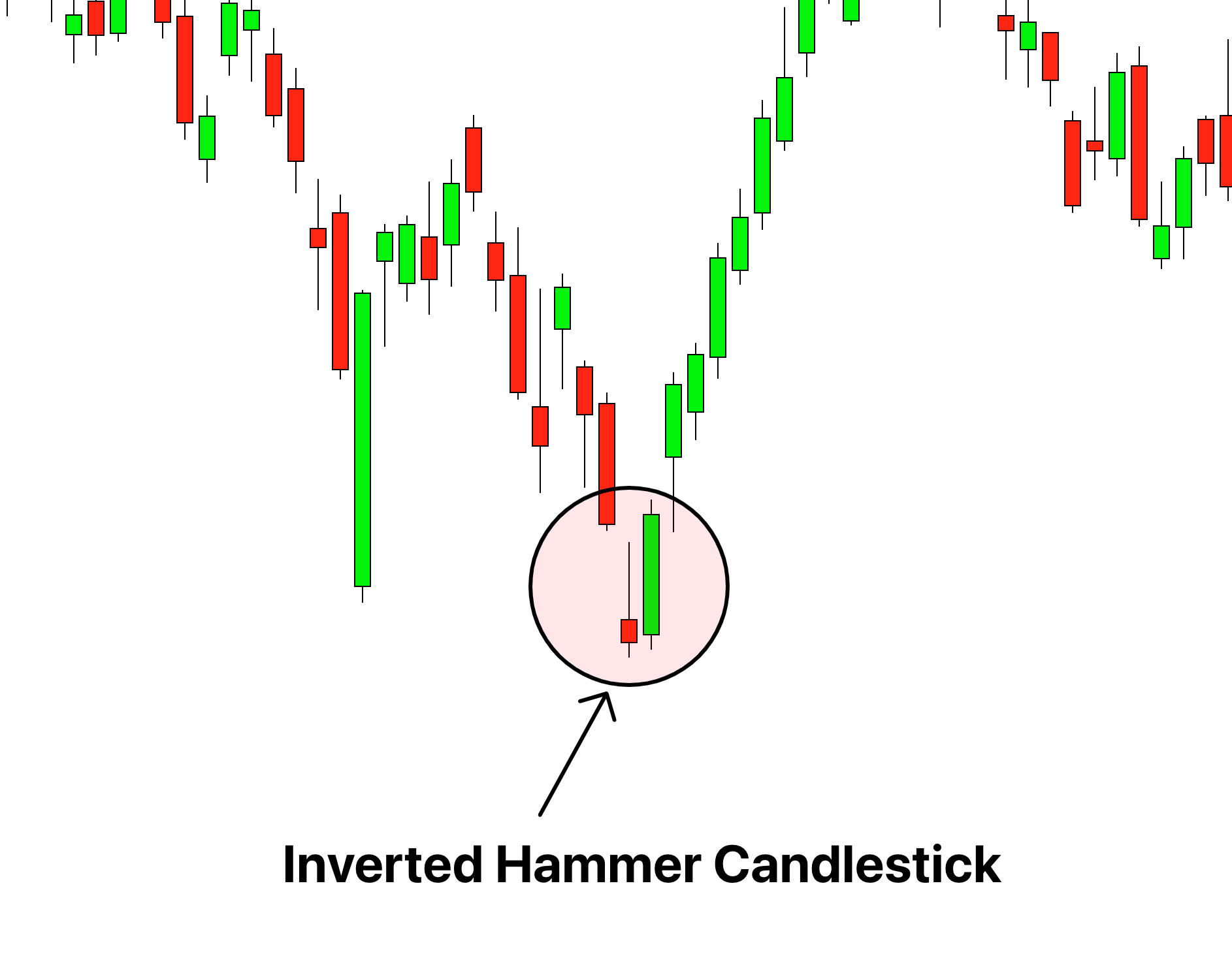

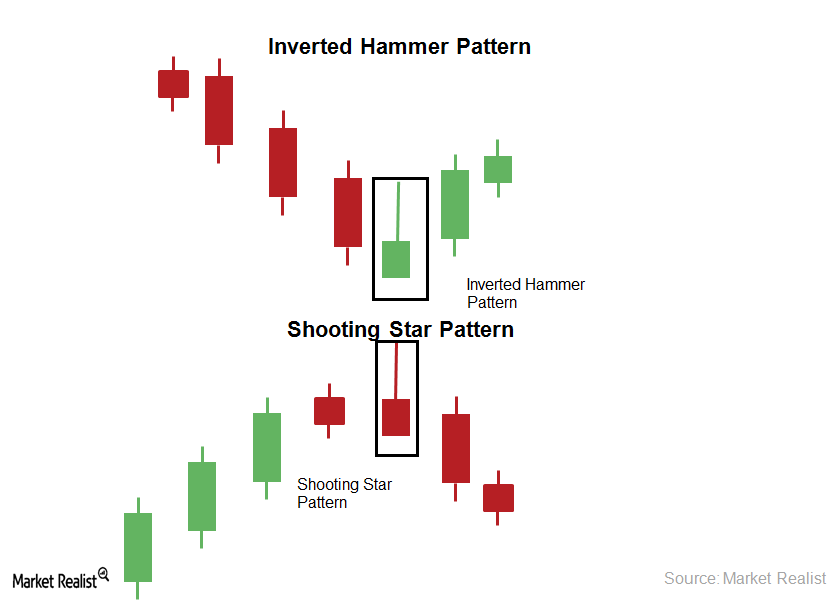

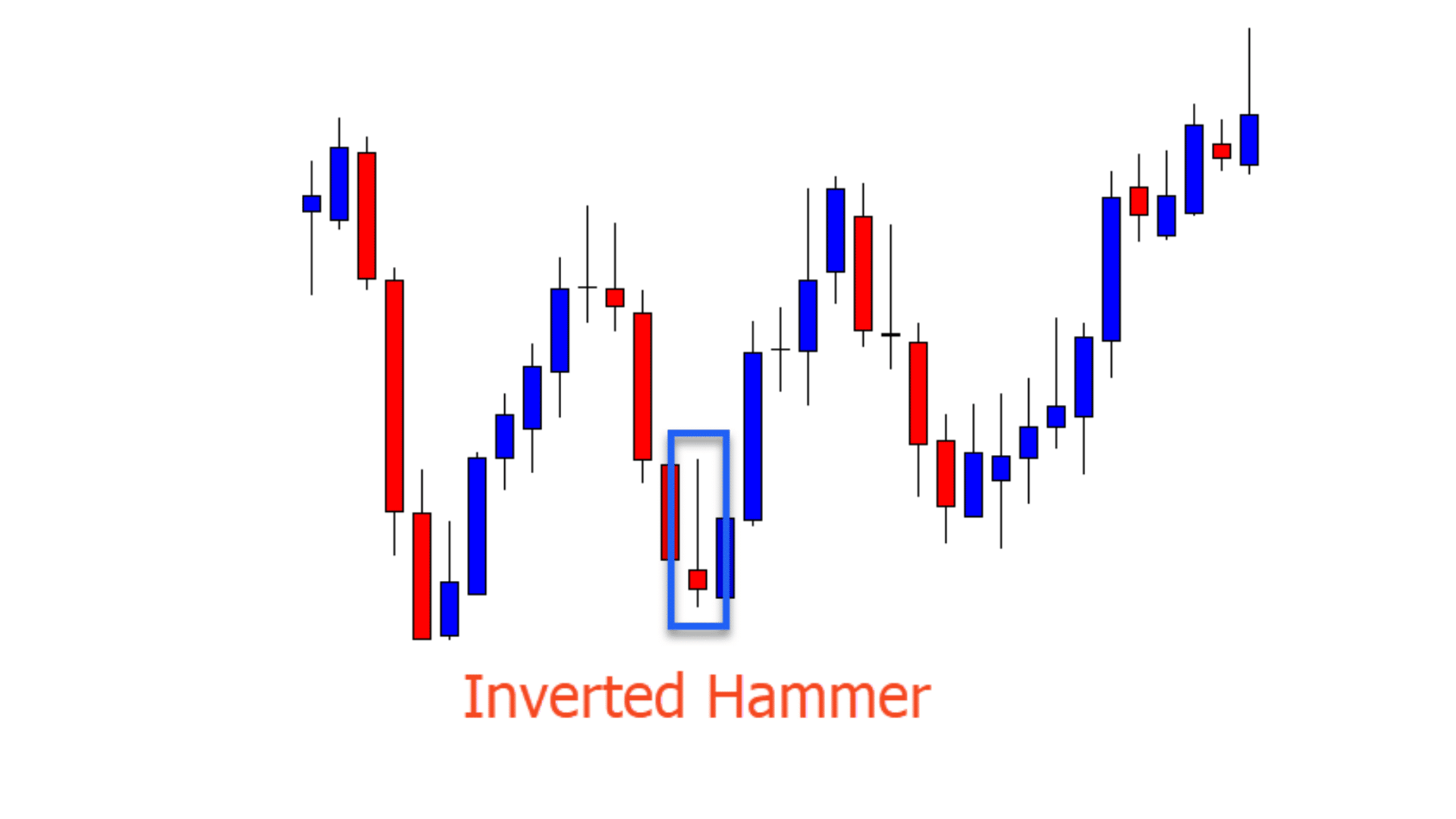

Inverted Hammer Candlestick Pattern - A hammer pattern is a candlestick that has a long lower wick and a short body. Typically, it will have the following characteristics: It signals a potential bullish reversal. Web what is the inverted hammer? How to identify the inverted hammer candlestick pattern. Let’s dissect this pattern to understand its formation, interpretation, and application in trading scenarios. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Candle with a small real body, a long upper wick and little to no lower wick. Now wait, i know what you’re thinking! Both are reversal patterns, and they occur at the bottom of a downtrend. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. A hammer pattern is a candlestick that has a long lower wick and a short body. Web what is the inverted hammer? Web what is an inverted hammer candlestick pattern? A long lower shadow, typically two times or more the length of the body. “isn’t the inverted hammer considered bullish?” Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Now wait, i know what you’re thinking! How to identify the inverted hammer candlestick pattern. A hammer pattern is a candlestick that has a long lower wick and a short body. Web how to spot an inverted hammer candlestick pattern: Let’s dissect this pattern to understand its formation, interpretation, and application in trading scenarios. Both are reversal patterns, and they occur at the bottom of a downtrend. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. A hammer pattern is a candlestick that has a long lower wick and a short body. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a. It signals a potential bullish reversal. Usually, one can find it at the end of a downward trend; What is a hammer candlestick pattern? Web what is an inverted hammer pattern in candlestick analysis? With little or no upper wick, a hammer candlestick should resemble a hammer. Web what is an inverted hammer pattern? Web what is an inverted hammer pattern in candlestick analysis? Web what is the inverted hammer candlestick pattern. The inverse hammer candlestick and shooting star patterns look identical but are found in different areas. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a. This specific pattern can act as a beacon, indicating potential price reversals. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. A hammer pattern is a candlestick that has a long lower wick and a short body. Web the hammer candlestick as. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate enough pressure to drive up an asset’s price. Web the inverted hammer candlestick is a single candle pattern that signals a potential bullish reversal. Web the hammer and the inverted hammer candlestick patterns are among. Both are reversal patterns, and they occur at the bottom of a downtrend. Let’s dissect this pattern to understand its formation, interpretation, and application in trading scenarios. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price. What is an inverted hammer candlestick? A long lower shadow, typically two times or more the length of the body. The first candle is bearish and continues the downtrend; If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Typically, it will have the following characteristics: “isn’t the inverted hammer considered bullish?” The body of the candle is short with a longer lower shadow. A small body at the upper end of the trading range. Let’s dissect this pattern to understand its formation, interpretation, and application in trading scenarios. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of. That is why it is called a ‘bullish reversal’ candlestick pattern. Both are reversal patterns, and they occur at the bottom of a downtrend. An inverted hammer is one of the most common candlestick patterns. Pros and cons of the inverted hammer candlestick; The inverse hammer candlestick and shooting star patterns look identical but are found in different areas. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. How to identify the inverted hammer candlestick pattern. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web how to identify an inverted hammer candlestick pattern? This specific pattern can act as a beacon, indicating potential price reversals. Web inverted hammer is a bullish trend reversal candlestick pattern consisting of two candles. Learn how to critically identify such trends. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. Web the inverted hammer candlestick is a single candle pattern that signals a potential bullish reversal. Key tips to do better in trading with the inverted hammer. Typically, it will have the following characteristics: Web in forex trading, the inverted hammer candlestick pattern holds significant importance. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Both are reversal patterns, and they occur at the bottom of a downtrend. Web what is an inverted hammer pattern in candlestick analysis?Inverted Hammer Candlestick Pattern Forex Trading

Bullish Inverted Hammer Candlestick Pattern ForexBee

Inverted Hammer Candlestick How to Trade with this Pattern

How to Read the Inverted Hammer Candlestick Pattern? (2022)

Understanding the Inverted Hammer Candlestick Pattern Premium Store

Inverted Hammer Candlestick Pattern (Bullish Reversal)

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

Understanding the Inverted Hammer Candlestick Pattern Premium Store

The Inverted Hammer And Shooting Star Candlestick Pattern

Inverted Hammer Candlestick Pattern Quick Trading Guide

Pros And Cons Of The Inverted Hammer Candlestick;

What Is An Inverted Hammer Candlestick?

Web In This Guide To Understanding The Inverted Hammer Candlestick Pattern, We’ll Show You What This Chart Looks Like, Explain Its Components, Teach You How To Interpret It With An Example, And How To Trade On It.

A Hammer Pattern Is A Candlestick That Has A Long Lower Wick And A Short Body.

Related Post: