Three Black Crows Pattern

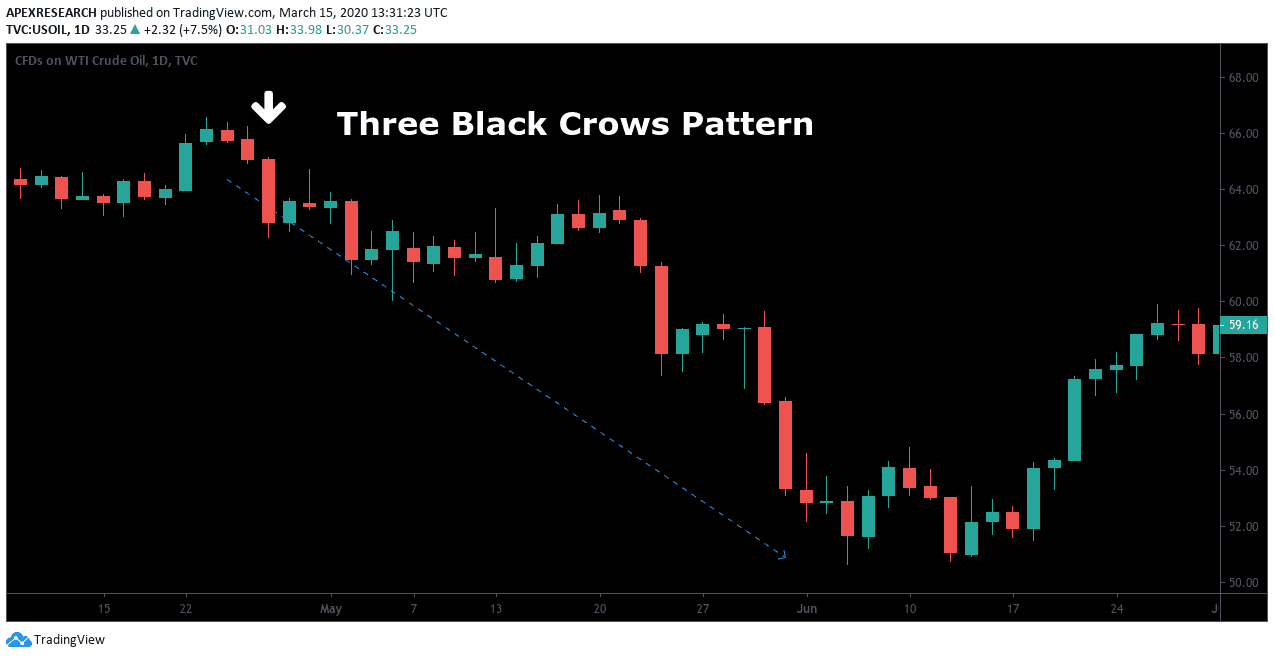

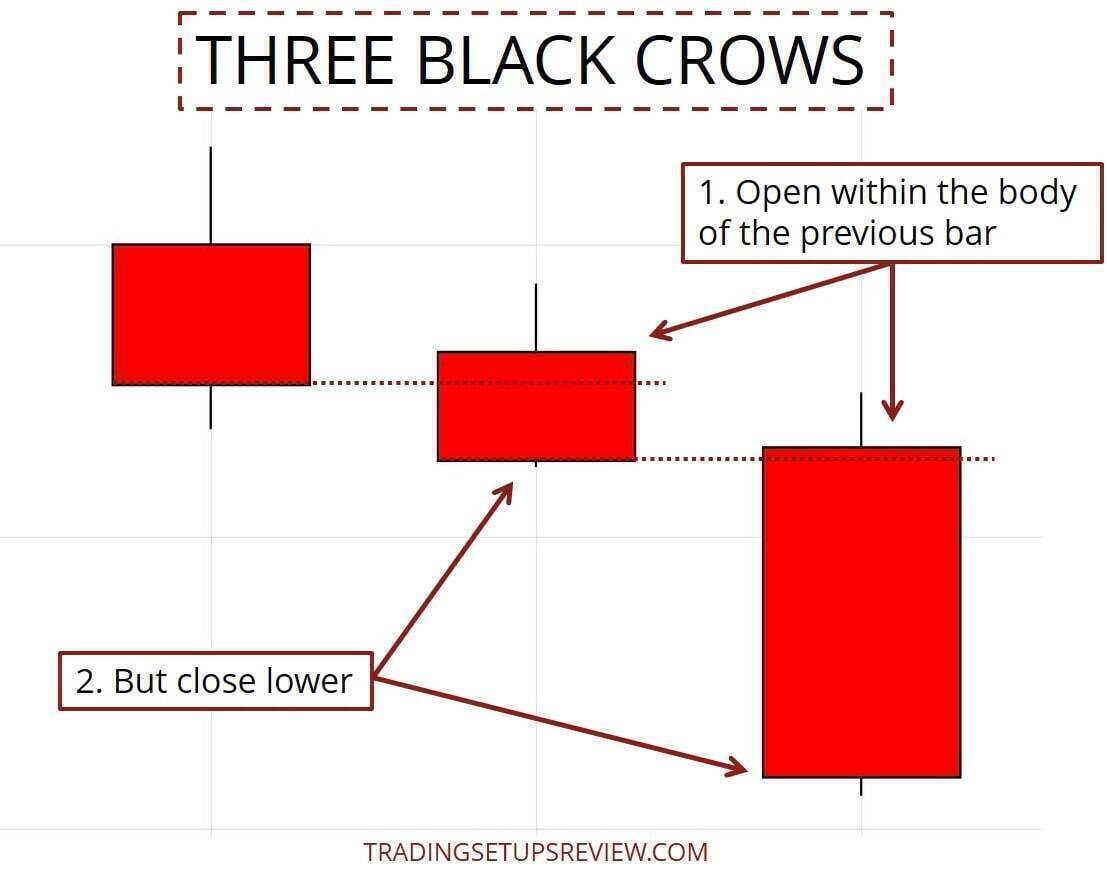

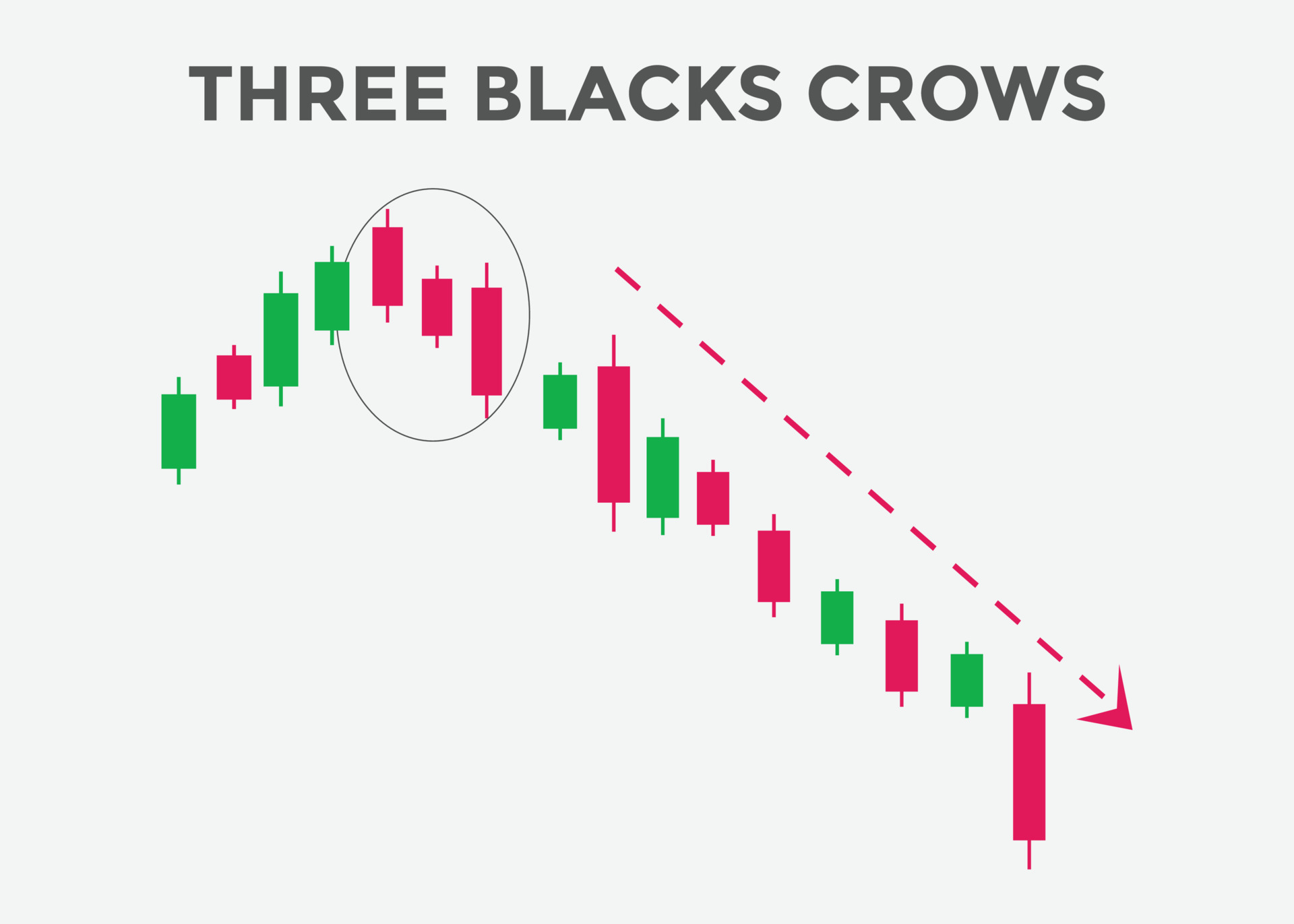

Three Black Crows Pattern - Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. It indicates a shift in market sentiment from bullish to bearish. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. These candles must open within the previous body or near the closing price. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. Three black crows may be commonly found in the cfd markets. Web what is the three black crows pattern? Learn how it signals bearish trends and shapes trading strategies. Web uncover the secrets of the three black crows pattern in 2024. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. The three black crows chart pattern is a bearish reversal candlestick pattern. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Traders use it alongside other technical indicators such as the relative. Three black crows may be commonly found in the cfd markets. It indicates a shift in market sentiment from bullish to bearish. Web what is the three black crows pattern? The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web learn the basics of the three black crows pattern and how analysts and traders interpret this bearish reversal pattern when creating a trading strategy. Three black crows may be commonly found in the cfd markets. It indicates a shift in market sentiment from bullish to bearish. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Web what is. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Three black crows may be commonly found in the cfd markets. Web the three black crows is. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the. These candles must open within the previous body or near the closing price. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Traders use it alongside other technical indicators such as the relative. Three black crows may be commonly found in the cfd markets. Web the three black. It indicates a potential reversal from an uptrend to a downtrend. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their. The three black crows chart pattern is a bearish reversal candlestick pattern. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Web uncover the secrets of the three black crows pattern in 2024. Web. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. Three black crows may be commonly found in the cfd markets. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive. Three black crows may be commonly found in the cfd markets. It indicates a potential reversal from an uptrend to a downtrend. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. Web uncover the secrets of the three black crows pattern in 2024. Web. It indicates a shift in market sentiment from bullish to bearish. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. Learn how it signals bearish trends and shapes trading strategies. Web what is the three black crows pattern? It consists. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. Learn how it signals bearish trends and shapes trading strategies. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Web three black crows is a bearish candlestick pattern used to. Learn how it signals bearish trends and shapes trading strategies. The three black crows chart pattern is a bearish reversal candlestick pattern. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web uncover the secrets of the three black crows pattern in 2024. Web what is the three black crows pattern? Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. It indicates a shift in market sentiment from bullish to bearish. Three black crows may be commonly found in the cfd markets. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. It indicates a potential reversal from an uptrend to a downtrend. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend.Learn How To Trade With Three Black Crows Pattern

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

What Are Three Black Crows Candlestick Patterns Explained ELM

Three Black Crows candlestick pattern. Powerful bearish Candlestick

How To Trade The Three Black Crows Pattern

Three Black Crows Definition

How To Trade The Three Black Crows Pattern

Three Black Crows Candlestick Pattern Explained LearnX

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

Three Black Crows Candlestick Pattern A Guide by Real Traders

Traders Use It Alongside Other Technical Indicators Such As The Relative.

These Candles Must Open Within The Previous Body Or Near The Closing Price.

Web Learn The Basics Of The Three Black Crows Pattern And How Analysts And Traders Interpret This Bearish Reversal Pattern When Creating A Trading Strategy.

Web The Three Black Crows Pattern Is A Bearish Reversal Pattern Consisting Of Three Consecutive Bearish Long Candlesticks That Trend Downward.

Related Post:

:max_bytes(150000):strip_icc()/The5MostPowerfulCandlestickPatterns3-f3b280e0165a4b2fa5e5d3b42b36e337.png)