Tripple Bottom Pattern

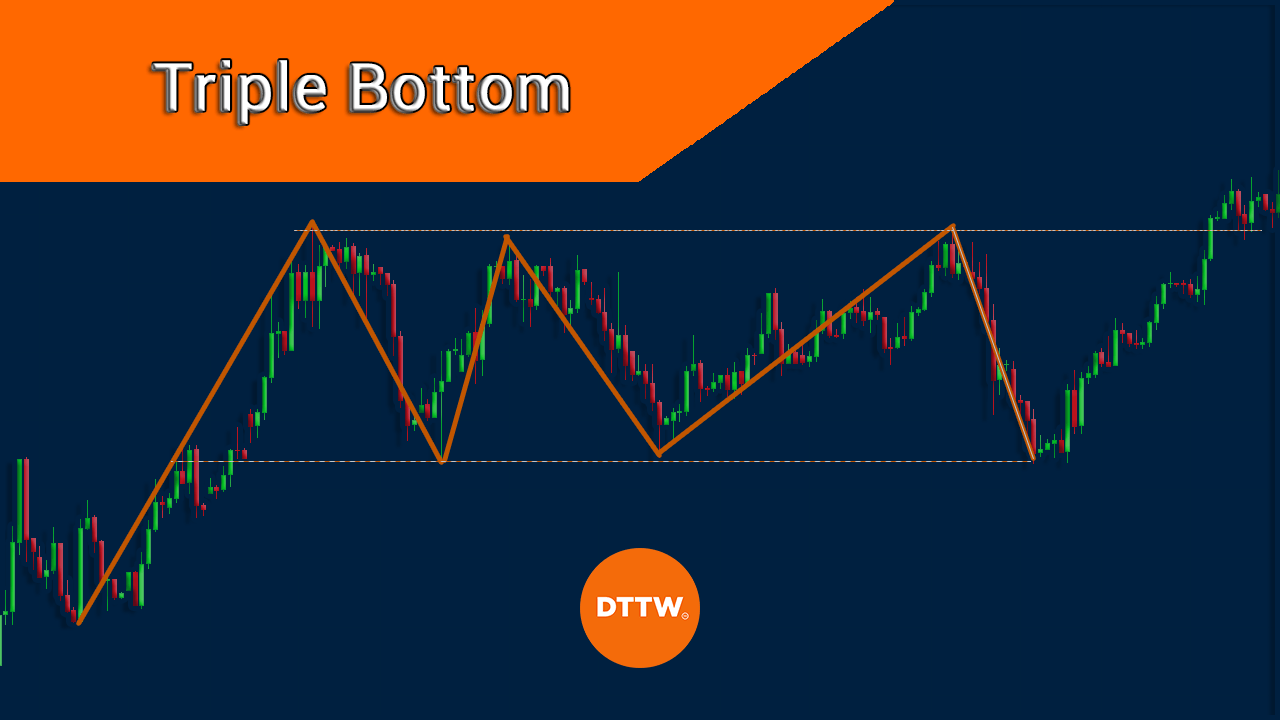

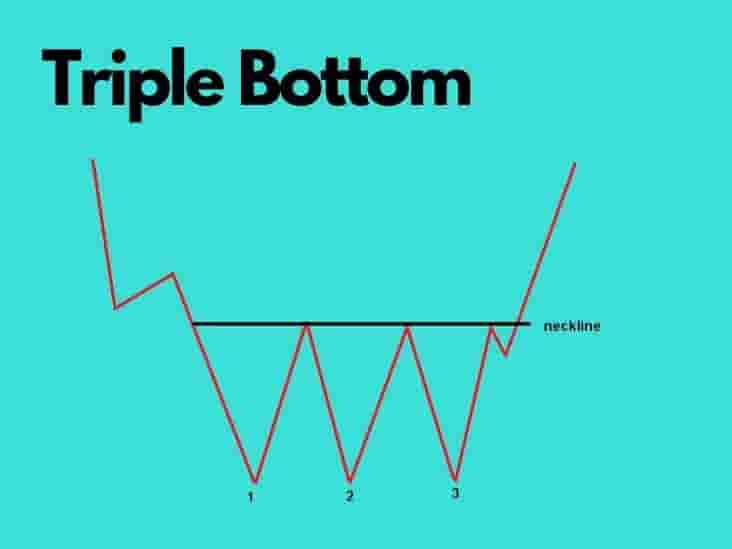

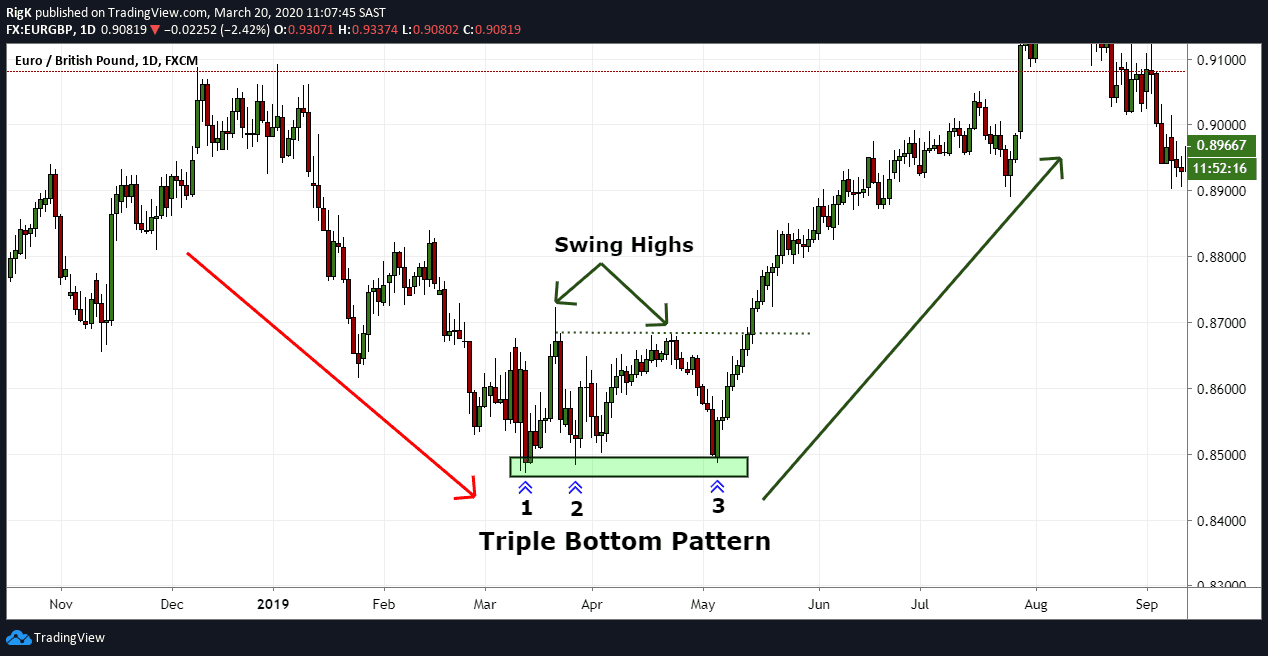

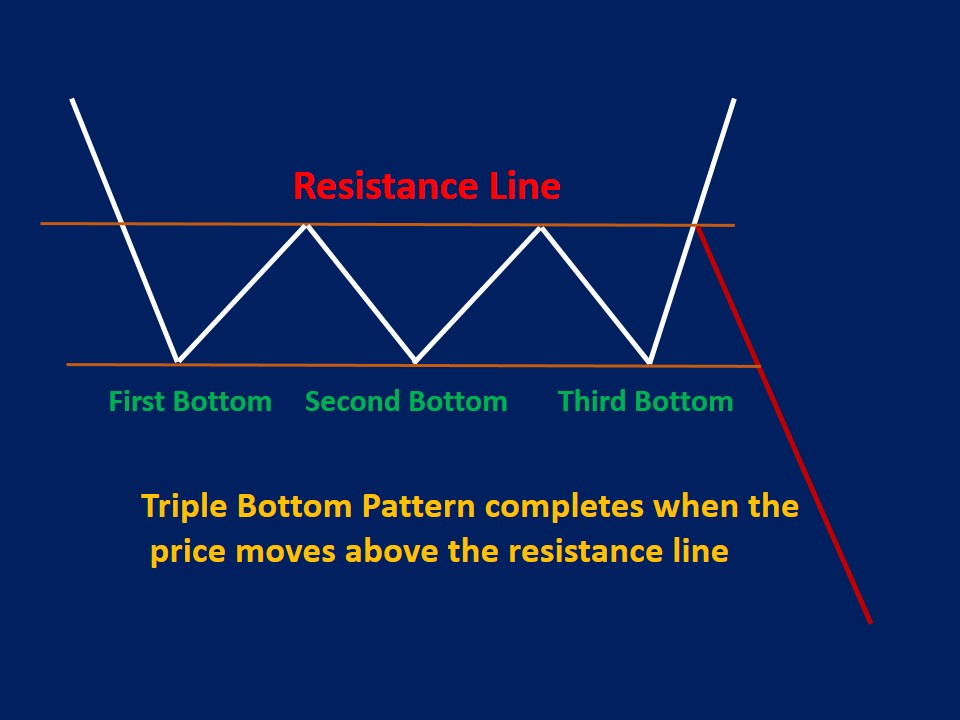

Tripple Bottom Pattern - Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. Web what is triple bottom pattern? When it happens, it usually increases the possibility that an asset’s price will start a new bullish trend. It develops when a support level is reached three times by the price without a major decline below it. Three troughs follow one another, indicating strong support. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Web what is the triple bottom pattern? The pattern consists of three consecutive bottoms or lows at or near the same level, creating a distinct support area. Web triple bottom patterns consist of several candlesticks that form three valleys or support levels that are either equal or near equal height. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. Read our guide to discover what it is, how to identify it and how to apply it in your trading in 2024. A triple bottom chart pattern is a bullish reversal chart pattern that is formed after the downtrend. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Web the triple bottom pattern offers a second chance for traders who missed the double bottom opportunity. A triple top or triple bottom pattern is a chart feature which traders of an asset, such as bitcoin (btc), ethereum (eth) or other cryptoassets, can use to catch major trend changes. The triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. This is a sign of a tendency towards a reversal. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading charts. This pattern is formed with three peaks below a resistance level/neckline. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. The triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web the triple bottom pattern works on the principles of support and resistance levels in technical analysis. The triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. A triple bottom pattern is a bullish. Web the triple bottom pattern works on the principles of support and resistance levels in technical analysis. For the triple bottom below, the support zone allows the price to bounce back three times. The pattern consists of three consecutive bottoms or lows at or near the same level, creating a distinct support area. Web the triple bottom pattern offers a. This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. Web a triple bottom pattern is one of the most popular bullish reversal patterns in the financial market. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while. The chart pattern is easy to identify, and its results frequently outperform our expectations. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. This pattern is characterized by three consecutive swing lows that occur nearly at the same price level followed by a. Web triple top and triple bottom patterns. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Think of this pattern like a trusty ally that nudges you, suggesting, “the market’s tide might be turning.” This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the. The first peak is formed after a strong downtrend and then retrace back to the neckline. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. The pattern consists of three consecutive bottoms or lows at or near the same level, creating a distinct. Web the triple bottom pattern offers a second chance for traders who missed the double bottom opportunity. The pattern consists of three consecutive bottoms or lows at or near the same level, creating a distinct support area. A triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. The pattern completes when. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. This pattern is characterized by three consecutive swing lows that occur nearly at the same price level followed by a breakout of the resistance level. Web triple top. Web what is triple bottom pattern? This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. The pattern consists of three consecutive bottoms or lows at or near the same level, creating a distinct support area. A triple bottom chart pattern is a bullish reversal chart pattern. Typically, when the third valley forms, it cannot hold support above the first two. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. This pattern is characterized by three consecutive swing lows that occur nearly at the same price level followed by a breakout of the resistance level. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web what is the triple bottom pattern? This is a sign of a tendency towards a reversal. The pattern completes when the price breaks above the resistance formed by the peaks between these lows. Read our guide to discover what it is, how to identify it and how to apply it in your trading in 2024. It involves monitoring price action to find a distinct pattern before the price launches higher. Web a triple bottom pattern is one of the most popular bullish reversal patterns in the financial market. The triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Web what is a triple bottom pattern? Web triple bottom patterns consist of several candlesticks that form three valleys or support levels that are either equal or near equal height. The first peak is formed after a strong downtrend and then retrace back to the neckline. Web the triple bottom pattern offers a second chance for traders who missed the double bottom opportunity. Web triple top and triple bottom patterns.Triple Bottom Pattern Chart Formation & Trading Strategies

Triple Bottom Chart Pattern Definition With Examples

How To Trade Triple Bottom Chart Pattern TradingAxe

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Pattern Explanation and Examples

Triple Bottom Pattern How to Trade & Examples

Reversal Candlestick Chart Patterns ThinkMarkets

How to trade Triple Bottom chart pattern EASY TRADES

The Triple Bottom Pattern is a bullish chart pattern. It occurs

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

The Chart Pattern Is Easy To Identify, And Its Results Frequently Outperform Our Expectations.

Web The Triple Bottom Chart Pattern Is A Technical Analysis Trading Strategy In Which The Trader Attempts To Identify A Reversal Point In The Market.

Think Of This Pattern Like A Trusty Ally That Nudges You, Suggesting, “The Market’s Tide Might Be Turning.”

Web The Triple Bottom Pattern Works On The Principles Of Support And Resistance Levels In Technical Analysis.

Related Post: